📘 William O’Neil is one of the legendary figures of Wall Street, a well-known trader, investor, and analyst, and the author of the classic book How to Make Money in Stocks. He created the unique CAN SLIM system, which combines fundamental and technical analysis and allows identifying stocks with high growth potential at early stages.

The main philosophy of O’Neil is simple yet profound: buy stocks not based on “rumors” or guesswork, but strictly according to specific chart signals and defined selection criteria. According to him, success in the stock market depends not on luck, but on discipline, proper analysis, and timely response to market signals.

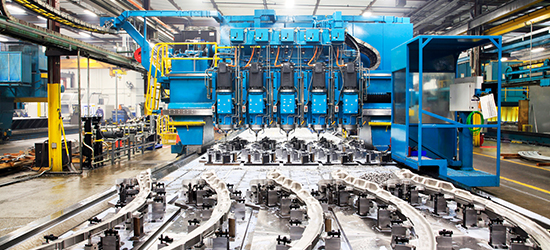

Case Study: Precision Castparts

Precision Castparts was a company producing high-tech components for the aviation, automotive, and industrial sectors. Its business was characterized by high margins and a stable market position. Later, the company was acquired by Warren Buffett through Berkshire Hathaway, confirming the fundamental strength of the business.

This story is an excellent example of how a disciplined trader can achieve significant profits by following the CAN SLIM system.

How Events Unfolded

1. Purchase

The company’s shares began a steady rise and broke a key resistance level around $40.

From O’Neil’s perspective, this was a signal that large institutional investors were entering the stock — they create a trend that can last for weeks or months.

Conclusion: purchases are made when the trend becomes upward and is accompanied by increased trading volume. This approach reduces the risk of buying a weak or stagnant asset.

2. Sale

After some time, the price fell below the 10-week moving average, and selling volumes increased. This was a sign of weakness.

O’Neil closed the position, locking in a profit of about +20%. He followed his rule: “Protect capital first, then profits.”

Lesson: it is important not to wait for a “miracle” — if the market shows the first signs of weakness, it is better to exit and preserve capital. Emotions are dangerous here.

3. New Opportunity

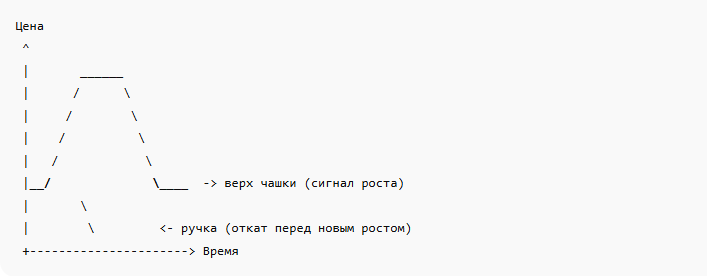

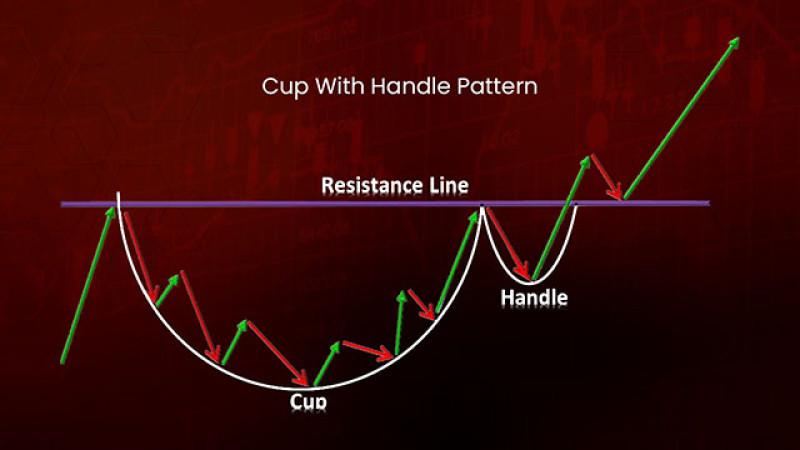

After a market correction, the shares formed a “cup with handle” pattern — one of the most well-known chart patterns, indicating the continuation of a strong uptrend. This is a chart formation described by O’Neil himself.

It consists of two parts:

- Cup: a smooth rounded bottom after a correction, indicating that the market has stabilized.

- Handle: a small pullback after breaking the cup, forming a safer entry point.

It roughly looks like this:

When the price broke the upper boundary of the formation, a new buy signal appeared. O’Neil bought shares at $61.45 and sold them 46 weeks later at $138, earning over 100% profit in a year.

Conclusion: a systematic approach allows not only minimizing risks but also maximizing strong trends without relying on luck.

Key Principles of O’Neil

- Buy strong stocks. Strong stocks rise on increased volume, confirming institutional investor interest.

- Sell at the first signs of weakness. Protecting capital is more important than holding a position “on principle.”

- Follow chart signals, not emotions. The market always gives a second chance — it is important to wait for a new signal instead of panicking or stubbornly holding a losing position.

- Money should work, not sit idle. If a stock is not rising, it is better to move to a more dynamic asset.

What This Means for Modern Investors

- Do not try to “guess” the market. Even legends like O’Neil and Buffett acted strictly according to signals.

- A systematic approach and discipline are more important than intuition.

- Knowing when to exit a position is not a failure, but capital protection.

- The market always provides new opportunities — just wait for the signal and act according to the rules.

📍 Summary

The story of Precision Castparts clearly shows how to achieve high returns by following a simple but disciplined principle: enter when the trend is strong — exit at the first signs of weakness.

William O’Neil demonstrated that successful investing is not about guessing or predicting, but about strictly following the system and making smart use of time and capital.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.