✨ In recent weeks, it’s everywhere: gold has hit an all-time high.

Central banks are hoarding it, investors call it “the eternal asset,” and analysts are once again drawing charts of “the great flight to gold.”

It all sounds logical — when the world shakes, gold becomes a safe haven again.

But honestly? We just don’t get it.

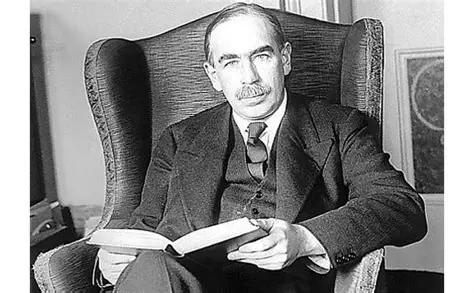

The “barbaric relic” Keynes warned about

A hundred years ago, British economist John Maynard Keynes called the gold standard a “barbaric relic” — and he wasn’t far off.

Gold produces no dividends, no interest, no energy, no food, no technology.

Its value is purely symbolic, built on faith and tradition.

Gold is hard to buy and even harder to sell

Try buying physical gold, not a paper ETF. You’ll face a list of headaches:

- You need a certificate of authenticity — without it, your bar is just a shiny trinket.

- You need secure, insured storage.

- And when you sell, expect to lose up to 10% in fees, testing, and refining.

Jewelry won’t save you either.

Rings, chains, bracelets — all valued at scrap prices. Your “gold reserve” in a jewelry box will return maybe half of what you spent.

Paying with gold? Only in historical novels

Imagine walking into a supermarket with a 100-gram bar, asking the cashier to weigh out “a few grams for bread and milk.”

Ridiculous? Exactly.

Even in a full-blown collapse, gold won’t help much.

When banks are down, there’s no power, and trade is barter — what will you do with your bar?

Swap it for a bottle of water? A loaf of bread? No one even knows how many grams that’s worth.

And let’s not forget: gold is heavy.

A single standard bar weighs 12.4 kilograms — not the ideal apocalypse wallet.

The world sits on $27 trillion worth of gold

Still, humanity clings to the golden illusion.

There’s roughly $27 trillion worth of gold in vaults worldwide — about a third of global GDP!

A massive fortune doing… absolutely nothing.

Why the world is turning back to gold

The answer lies in waning faith in U.S. debt.

For decades, U.S. Treasuries were seen as “risk-free assets.” Today — not so much.

Ballooning deficits, political turmoil, and currency wars have central banks searching for alternatives.

But replacing faith in the dollar with faith in a metal?

That’s the true barbaric relic — not an investment, but a ritual, a psychological defense against uncertainty.

Buffett was right — and maybe a bit mocking

Warren Buffett once said: “If you took all the gold in the world, you could melt it into a cube and just sit on it. It won’t produce anything.” He also joked: “People pay others to dig gold out of the ground, then pay different people to bury it again — and even more people to guard the hole.”

In short, gold is a loop of meaningless labor, justified by words like “tradition” and “security.”

What truly matters in the 21st century

Real value today lies in resources and technologies that sustain life:

food, water, energy, medicine, data, security, and supply chain stability.

That’s the true “gold” of our era.

Currencies may collapse, markets may burn — but we’ll still need electricity, the internet, clean water, and medicine.

And gold bars? They’ll still just sit there.

📊 The takeaway

Gold isn’t an investment — it’s a cultural myth, a legacy of ancient times when shine equaled strength.

Today, it’s a symbol of fear of change.

And if humanity keeps seeking safety in metal instead of reason — then perhaps we’re not living in the future, but still trapped in history.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.