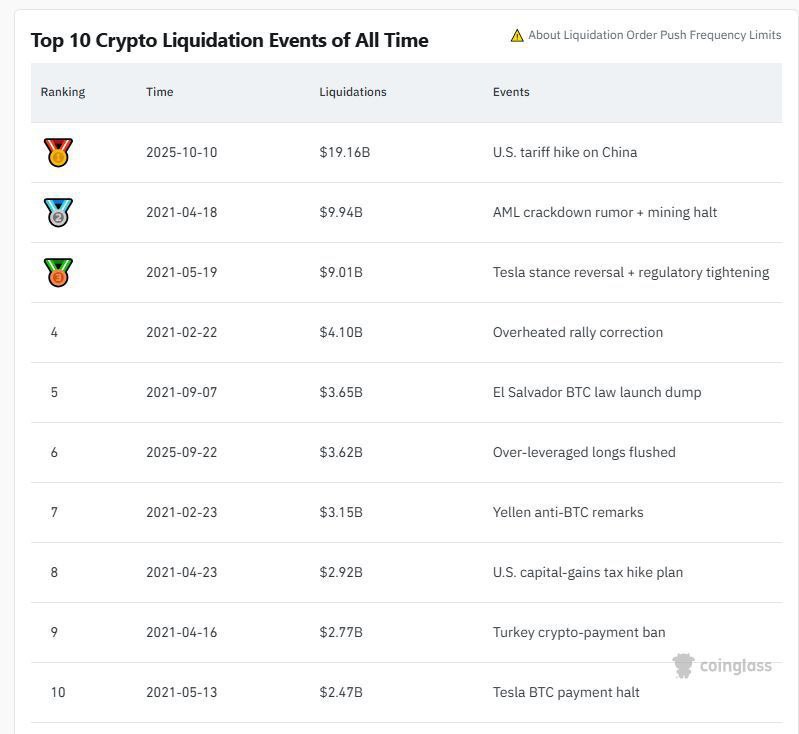

📉 The crypto market has once again made history — and, unfortunately, not in a positive way. According to Coinglass, the largest liquidation ever occurred on October 10, 2025, when news of 100% U.S. tariffs on Chinese goods triggered a massive sell-off.

Within just a few hours, $19.16 billion worth of positions were wiped out — a record that surpassed even the infamous “bloody days” of 2021.

Historical Comparisons

To grasp the scale:

- April–May 2021 — regulatory crackdowns in China and Tesla’s reversal on bitcoin caused a nearly $9 billion crash.

- September 2021, “El Salvador dump” — the launch of the BTC law led to mass sell-offs, removing several billion dollars from the market.

- September 22, 2025 — the plunge caused by overleveraged position liquidations became the sixth-largest liquidation in market history.

October 2025 Crash

The uniqueness of this event lies not only in its size but in the chain reaction it triggered:

- Amid political threats from Trump and growing economic uncertainty, investors began to close positions en masse.

- Algorithmic liquidations amplified the effect — a true domino wave spread across the market.

- In just hours, months of profits vanished, even for large institutional traders.

Lessons for the Market

Experts note that this case will become a textbook example of risk management:

- The market can crash even without an internal crisis — one tweet and new tariffs are enough.

- he crypto market has become extremely interconnected and reactive.

- Understanding leverage risk and the liquidation mechanism has become an essential skill for every trader.

Top 10 Biggest Liquidations (based on Coinglass data)

- October 10, 2025 — $19.16B

- May 2021 — ~$9B

- April 2021 — ~$8.5B

- March 2020, “Black Thursday” — ~$5.5B

- September 2021, El Salvador — ~$4.7B

- September 22, 2025 — ~$4.2B

- February 2022, BTC drop amid sanctions — ~$3.8B

- June 2021, ETH reversal after hard fork — ~$3.5B

- January 2021, first major institutional buys — ~$3B

- July 2023, FTX-related liquidations — ~$2.8B

📊 Key takeaway

The crypto market has become too interconnected and reactive. One political statement — and $19 billion turns to dust.

For traders and investors, the message is clear: there’s no such thing as a “too safe” position. Learn to manage risk — and leave emotions outside the door.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.