📅 October 13–19, 2025

A new week promises to be eventful for global markets and investors. The corporate earnings season kicks off, political battles in the U.S. intensify, and the energy and crypto markets remain turbulent. Here are five key themes that will shape investor sentiment in the coming days.

1. Earnings Season Begins: Banks Set the Tone

Leading financial giants — JPMorgan, Goldman Sachs, Citigroup, and Wells Fargo — will be the first to report. Investors will closely monitor their comments on lending activity, default rates, and forecasts for the rest of the year.

Particular attention will be paid to retail lending and the mortgage market — key indicators of a U.S. economic slowdown.

According to analysts, bank profits could decline by 8–10% year over year due to lower fee income and reduced demand for investment products.

2. U.S. Government Shutdown: A Risk for Inflation Data

The ongoing partial shutdown of federal agencies threatens to delay key macroeconomic releases — notably, the Consumer Price Index (CPI), which was due out Thursday.

Without these figures, the Federal Reserve will find it harder to assess inflationary pressures ahead of its November meeting.

If publications are delayed, markets may react more sharply to indirect signals — from official comments to energy price movements.

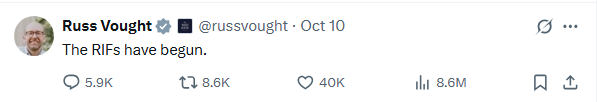

White House budget director Russ Vought confirmed in X the start of layoffs, using the phrase “The RIFs have begun.”

3. China to Release Q3 GDP Data

China’s economy remains under close investor scrutiny. GDP growth is expected at 4.3%, slightly below the previous quarter.

Any deviation from forecasts could trigger chain reactions across commodity and currency markets — particularly in Asia.

In addition, China plans to announce new support measures for the private sector, including tax cuts and incentives to boost domestic demand.

4. Energy Sector: Oil and Gas Recover After Slump

After hitting five-month lows, oil prices have started to rebound. Investors await fresh forecasts from the IEA (International Energy Agency) and OPEC+, with the main focus on balancing rising supply and unstable demand.

Particular attention will be on the Middle East and the U.S. domestic market — where drilling activity is rising for the first time in six months.

Meanwhile, Europe is discussing expanding strategic gas reserves ahead of the winter season.

5. Crypto Market: Calm After the Storm

After the sharp sell-off on October 10 and Binance’s statement about technical failures, the crypto market is gradually regaining ground.

Bitcoin remains above $54,000, and Ethereum has recovered more than half its losses.

However, analysts warn that volatility remains high, and any new development — from SEC decisions on ETFs to macro data — could trigger another wave of selling.

Against this backdrop, interest in decentralized platforms and hardware wallets is growing, with record sales reported.

🎯 Bottom Line:

This week promises to be volatile and complex. Investors will navigate between earnings results, geopolitics, and data that might not even be released due to Washington’s bureaucratic gridlock.

The main strategy — cautious optimism: the market is searching for footing but has yet to find solid ground.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.