💸 Bitcoin plunged by more than 10% after Donald Trump announced 100% tariffs on Chinese goods. Within 24 hours, a record $19.31 billion worth of positions were liquidated — more than during the COVID-19 crash ($1.2 billion) and the FTX bankruptcy ($1.6 billion) combined.

For the crypto market, this isn’t just a correction — it’s a shockwave that instantly wiped out months of growth and confidence.

But not everyone sees disaster in the crash. Crypto trader Alex Becker said that selling now is the most irrational thing to do.

Panic as a sign of a bull market’s beginning

“I believe there’s a very high probability this is the start of a new bull cycle,” Becker said in a YouTube video. According to him, the sharp drop on October 10 was caused by emotional market exhaustion, not fundamental issues.

“We’ve been watching Bitcoin rise all year while other assets stood still. Investors got tired of waiting, started panicking, and now the market has simply cleared out the excess noise,” he explained.

Samson Mow, founder of Jan3, agreed. On X, he wrote: “It’s time for Bitcoin’s next leg up.”

Becker believes the current volatility is the result of manipulation by major players. Market makers, he said, “pull the levers up and down,” forcing crowds to panic and sell at the lowest prices. As a result, even small moves are amplified three to four times — not because of macroeconomics, but because of human psychology.

When fear becomes fuel

The history of the crypto market shows that periods of panic have almost always preceded major upward moves.

After the FTX collapse in 2022, Bitcoin was under $16,000. A year later — over $70,000. Those who sold in panic watched the rally from the sidelines.

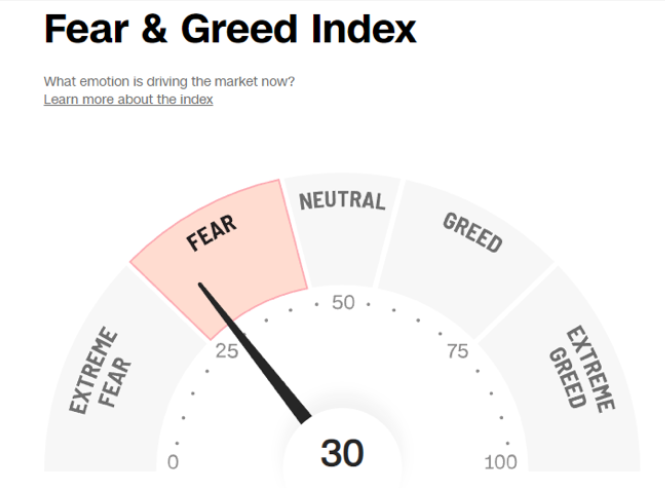

Now, the Fear and Greed Index sits at 24 out of 100 — “extreme fear.”

According to Becker, these are exactly the moments when the best opportunities emerge.

“When everyone is sure it can’t get any worse — that’s the turning point. What matters isn’t emotion but discipline,” he said.

Short-term outlook: cautious optimism

On October 7, Bitcoin reached a new all-time high of $125,100. Yes, it’s still far from the $250,000 year-end forecasts made by Tom Lee (Fundstrat) and Arthur Hayes (BitMEX), but the uptrend remains intact.

Crypto analyst Benjamin Cowen also stays optimistic: “In the short term, the market will continue to rise. Bitcoin dominance has reached 60% again — a strong signal that capital is flowing back to the main asset.”

Essentially, Becker and Cowen are saying the same thing: the crash isn’t a collapse — it’s a reset. The market is shaking out weak hands to start a new growth cycle.

Why selling now really is dumb

At times like these, the key strategy isn’t greed but survival. The goal isn’t to profit from every move, but to avoid losses.

A market cleared of speculators always rewards those who remain calm.

“We’re seeing a natural cleansing,” Becker explained. “On days like this, most people lose because of panic. But those who ride out the storm end up on top.”

History repeats itself: mass sell-offs are the final stage before recovery. The drop, analysts say, doesn’t negate fundamentals — shrinking supply, the upcoming halving, and growing institutional interest.

What’s next

Statistics show that such crashes almost always precede new surges. Over the past decade, Bitcoin has experienced 14 corrections greater than 20% — and 13 of them ended in new all-time highs.

A “crypto winter” scenario is unlikely for now: trading volumes remain high, and long-term holders aren’t reducing their positions.

Analysts expect that once macroeconomic pressures and tariff headlines ease, the market will return to growth within a few weeks.

💬 Bottom line: selling now is truly the dumbest thing to do.

The market doesn’t move on news — it moves in cycles. Those who understand that have already stopped fearing volatility.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.