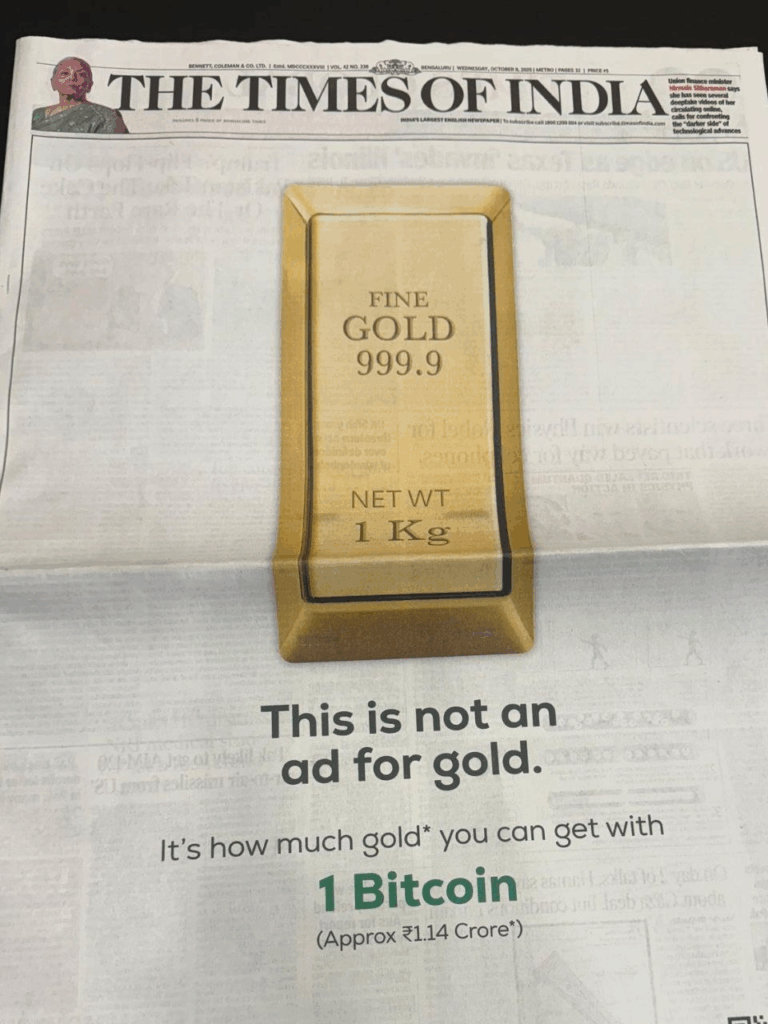

📰 On the cover of the latest issue of The Times of India, the largest and oldest English-language newspaper in India, appeared a one-kilogram gold bar. The publication reminded readers: today, 1 bitcoin can buy 1 kilogram of gold.

The cover caption reads: “This is not a gold advertisement. This is how much gold you can get for 1 BTC.”

The very fact that The Times of India — a media giant with nearly two centuries of history and an impeccable reputation — is addressing such a topic adds symbolic weight. The newspaper rarely covers crypto, so this feature can be seen as a reflection of how Bitcoin has truly entered the global economic agenda, becoming a kind of “digital equivalent of gold.”

The media symbolism is no coincidence. Today, the price ratio is indeed striking: Bitcoin has approached its all-time high, and one coin now buys roughly one kilogram of gold. For many investors, it’s a vivid reminder that “digital gold” has lived up to its name.

The comparison between Bitcoin and gold is not new, but in 2025 it gained a new meaning. Both assets are experiencing a “renaissance” amid global economic uncertainty. Gold is breaking records, surpassing $4,000 per ounce, while Bitcoin has once again become a symbol of independence from the banking system. For instance, see the article “Gold and Bitcoin vs. the Dollar.”

Experts note that the similarity in their dynamics is not accidental:

- Central banks continue printing money and keeping interest rates low, pushing investors toward capital protection.

- Rising geopolitical tensions and the U.S. government shutdown drive markets to seek “safe havens.”

- Institutional investors are returning to crypto, viewing BTC as a “digital alternative to gold.”

However, differences remain. Gold is a physical, time-tested store of value. Bitcoin is volatile but technologically advanced, potentially becoming part of the digital financial infrastructure.

Amid the discussion, the hashtag #1BTC1KG is gaining popularity, symbolizing a new stage in Bitcoin’s perception — not as speculation, but as the digital equivalent of 21st-century gold.

Some analysts even joke: “If gold is the past, Bitcoin is its tokenized version.”

⚖️ And it seems The Times of India has simply captured the moment when that metaphor became reality.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.