What Moves the Markets Today (October 8, 2025)

💰 Gold Back in the Spotlight

The price of gold has surpassed $4,000 per ounce for the first time in history (we previously wrote here about the true “gold rush” currently sweeping global markets).

This surge is driven by growing uncertainty: the U.S. government shutdown, political tensions in Europe, and expectations of rate cuts are pushing investors toward capital protection. Central banks — from China to India — continue to accumulate gold reserves. The market is already calling 2025 the best year for gold since the late 1970s, when the metal became a symbol of financial stability.

Artificial Intelligence: Investment Momentum Continues

AI remains at the center of the tech race. Nvidia announced a $2 billion investment in Elon Musk’s xAI project — a move that strengthens its position in the field of generative models and advances its “AI infrastructure of the future” strategy. AMD and IBM shares are rising thanks to new alliances and next-generation chip development, while Oracle faces pressure due to weak profitability in its AI division and intense competition in the corporate market.

Stock Markets Take a Breather

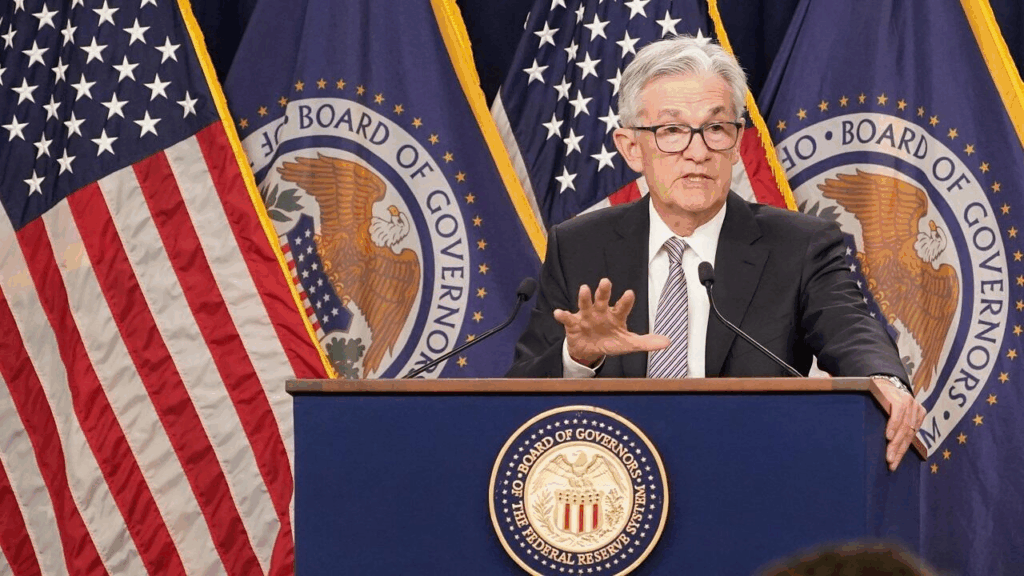

After a series of record highs, a correction was inevitable. Key reasons: rising inflation expectations, weak labor market data, and uncertainty over the Fed’s next moves. Investors are temporarily reducing their exposure to equities and shifting toward bonds and commodities.

Major Deals and Strategic Moves

ABB has finalized the sale of its robotics division to SoftBank for $5.38 billion. The move strengthens the Japanese conglomerate’s position in the emerging field of “physical AI” — the fusion of artificial intelligence and robotics. Analysts believe this area could become the next technological breakthrough of the decade.

What’s Next?

The main event of the week — the release of the Federal Reserve minutes. Any hints of rate cuts will be scrutinized by market participants. A shift toward monetary easing could reshape the balance between risk and safe-haven assets and set the tone for the fourth quarter.

Analytical Summary:

Markets are entering a phase of cautious optimism: gold and AI remain the key beneficiaries of uncertainty. While investors await signals from the Fed, it makes sense to diversify portfolios — combining defensive assets (gold, bonds) with technology plays tied to artificial intelligence. Balance is the key to staying calm through a turbulent October.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.