👵 The global economy is gradually entering an era where the key growth drivers are not only technology and innovation but also demography. Aging populations and rising global wealth could become powerful drivers for the cryptocurrency market well into the 21st century. According to research from the Federal Reserve Bank of Kansas City, demographic shifts alone could trigger unprecedented demand for digital assets, including Bitcoin.

Kansascityfed.org

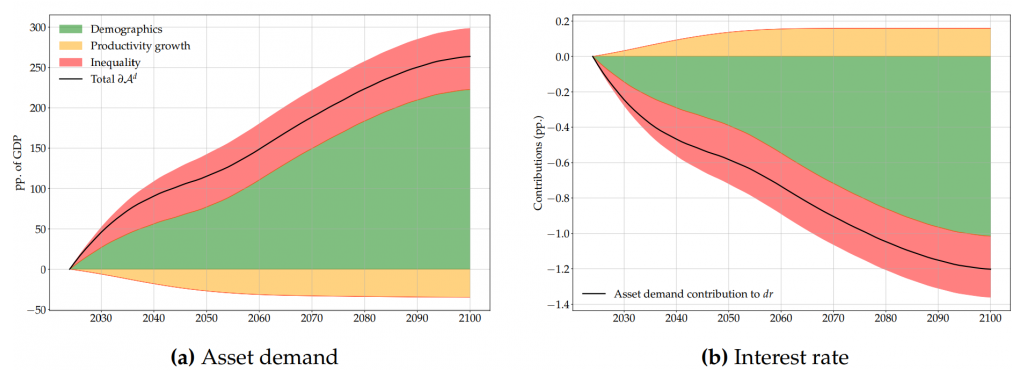

“Aging populations mean that the upward trend in asset demand observed over recent decades will continue,” the research report published on August 25 states. “We forecast that aging will increase asset demand by an additional 200% of GDP between 2024 and 2100.”

Demography Sets the Rules

Population aging is not just statistics — it is a fundamental trend affecting financial markets. Each new decade will bring more elderly investors with capital who are focused on preserving wealth. At the same time, global productivity growth will increase overall wealth, which also needs to be allocated to assets.

From a Risky Asset to Digital Gold

The Kansas City Fed study suggests that by 2100, demand for assets could grow by an additional 200% of global GDP. This trend will push real interest rates down and boost interest in alternative investments. Enter Bitcoin — the digital gold of the 21st century.

From a Risky Asset to Digital Gold

Today, Bitcoin is often perceived as a risky instrument, but the situation is changing rapidly. Gradual regulatory maturity, infrastructure development, and growing government support are making it increasingly attractive even to conservative investors.

Gracy Chen, CEO of crypto exchange Bitget, notes: “In 75 years, an aging population will value Bitcoin as highly as gold is valued today.” And this is not just words: Bitcoin already occupies 30.95% of investors’ portfolios (May 2025) compared to 25.4% in November 2024. Cryptocurrency is gradually establishing itself as a key defensive asset.

The Investor Profile Is Changing

According to Triple-A, by the end of 2024, about 34% of cryptocurrency holders were aged 24–35. But the generation of crypto enthusiasts is aging, and the market is maturing along with them. If crypto was previously associated with fast, risky trades, it is now becoming part of a long-term wealth preservation strategy.

Different ages lead to different investment approaches. Older investors will view Bitcoin as a “digital safe,” while younger, tech-savvy investors will see it as a playground for experimenting with altcoins, Web3, and new projects.

Demography and Capital: Wealth Drives Diversification

Bitfinex analysts emphasize that rising global wealth expands investment horizons and increases risk appetite. The more capital people have, the higher the interest in new assets. This is why cryptocurrencies are becoming not a marginal alternative but a full-fledged part of investment portfolios.

This is particularly true for long-term investors — those willing to “lock up” capital for decades. For them, Bitcoin can serve not only as a diversification tool but also as a hedge against inflation, geopolitical risks, and instability in traditional financial systems.

🔮 What It Means for the Future

If the Kansas City Fed’s forecasts are correct, by the end of the century, Bitcoin will no longer be an “alternative asset.” It will become as standard a part of the financial system as bonds or gold are today. The crypto industry itself will become an integral part of the global economy, with digital assets serving not only speculative trades but also pension funds, insurance reserves, and government budgets.

Essentially, we are witnessing a paradigm shift: demography and capital together are pushing cryptocurrencies to become the “new standard” for the financial century ahead.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.