🏆 CZ trolled the whole story around gold reaching sky-high levels.

While global markets are buzzing over gold hitting a new historical high, former Binance CEO Changpeng Zhao (CZ) couldn’t resist commenting. His post became a meme of the day in the crypto community.

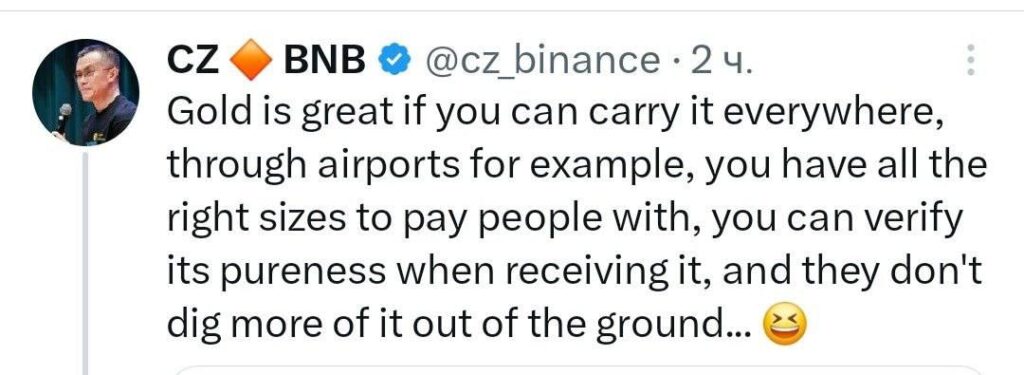

CZ noted that gold, of course, is a good asset, but only under very specific conditions:

“Gold is great if you can carry it everywhere, for example, through airports. Or if you have a full set of different sizes of bars to pay people with. Or if you can verify its purity with every transaction. And, of course, if gold suddenly stops being mined,” he wrote.

Essentially, Zhao highlighted the key limitations of physical gold: transport inconvenience, divisibility issues, the need for expert evaluation for every exchange, and the risk of supply inflation due to mining.

The crypto community interpreted his comment as a subtle hint that Bitcoin solves all these problems. Indeed: Bitcoin can be sent in seconds to anywhere in the world, its divisibility is limited only to 8 decimal places, and issuance is strictly capped by the algorithm — 21 million coins, not a gram more.

The irony is that gold now costs nearly $3,800 per ounce and continues to rise amid Jerome Powell’s statements and growing interest in safe-haven assets. But CZ reminded the market: shiny metal belongs to the past century, while digital gold in the form of Bitcoin may be a more practical tool for accumulation and payments in today’s world.

✨ For some, his words are an ironic trolling of gold bulls. For others, it’s a reminder that Bitcoin and gold are now competing for the status of the “primary safe-haven asset.”

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.