🏆 Federal Reserve Chair Jerome Powell delivered a speech that once again cooled investor optimism. Despite expectations, he did not signal that the Fed will necessarily cut rates in October. On the contrary, his words contained a cautious hint: a pause or even holding the rate steady is now a plausible scenario.

Markets had expected that Powell’s speech would confirm what he had already made clear last week: a 25-basis-point rate cut is unlikely to be the only one in 2025.

Indeed, the central bank chief’s remarks did not disappoint these expectations.

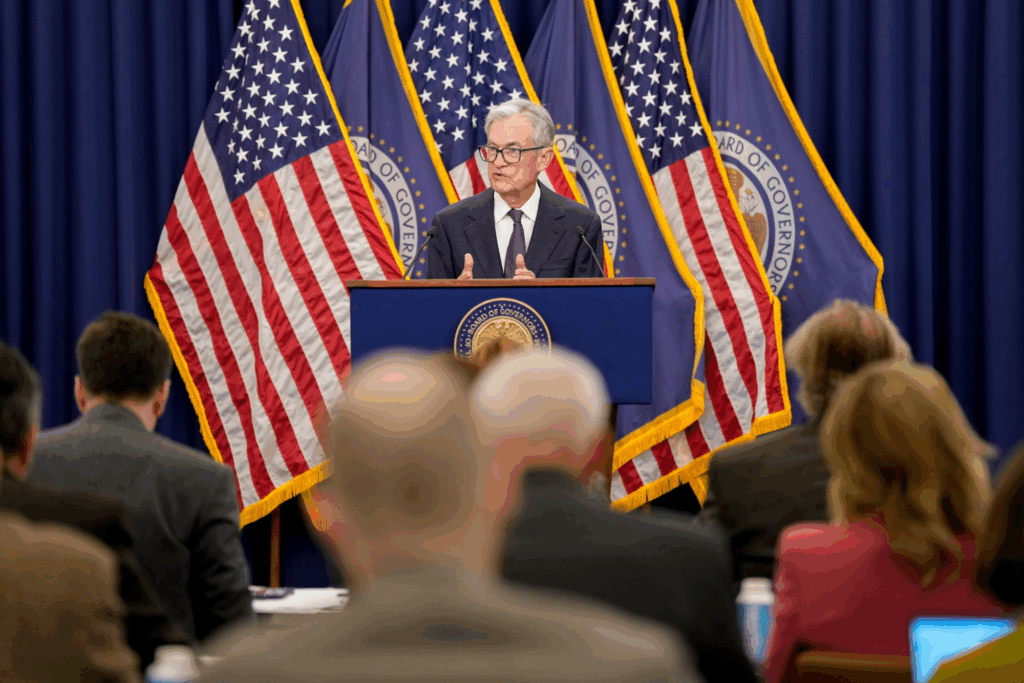

Federal Reserve Chair: Jerome Powell

Photo: Kent Nishimura/Bloomberg

Powell effectively stated that the Fed’s monetary policy remains “moderately restrictive” even after the recent cut, meaning there is still room for maneuver. In other words, the regulator allows for further easing this year if officials continue to believe that labor market weakness outweighs inflation threats.

In his speech in Providence, Rhode Island, Powell largely reiterated points he made during the press conference after the September meeting. He emphasized that the Fed faces a dual task — keeping inflation low and stable while supporting a healthy labor market. According to him, “two-sided risks imply there is no risk-free path.”

He clarified that too sharp and rapid a rate cut could push inflation back toward 3% rather than the 2% target. At the same time, maintaining overly tight policy for too long could unnecessarily weaken employment and slow economic activity.

Powell also noted that the summer slowdown in job growth caused the Fed to shift its focus: more attention is now paid to the labor market than at the beginning of the year. The moderately restrictive rate, he said, allows the regulator to respond flexibly to potential changes in the economy. He also directly stated that “stock prices are quite high.”

Indeed, equity markets continued to rise and hit record highs after the quarter-point rate cut was implemented.

However, investor reaction to his speech was muted: indices fell to intraday lows, Bitcoin also declined, while gold, on the contrary, strengthened, rising nearly to $3,800 per ounce and reaffirming its status as a “safe haven.”

🔑 Five key takeaways from Powell’s speech:

- “Cheap shot” at the Fed. Powell sharply responded to accusations that the Fed’s decisions are politically motivated. He called such criticisms a “cheap shot” and emphasized the Fed’s independence.

- No signals on rates. When asked about October, Powell essentially shrugged: there is too much uncertainty to promise anything.

- No “safe path.” According to Powell, the Fed currently has no option guaranteed to avoid problems. Supporting the economy with rate cuts could spark inflation. Fighting inflation too aggressively could hurt the labor market.

- Inflation remains a threat. Price risks remain “upside.” Tariffs could cause a one-time price spike, and it is still unclear how long this effect will last. The Fed’s goal of returning inflation to 2% has not yet been achieved.

- Labor market: weakness with a “balance.” Employment is weakening, but at the same time, both demand for workers and labor supply have declined. Powell called this an “unusual equilibrium.”

⚖️ Key takeaway from Powell’s speech: The Fed remains in a balancing mode. On one hand — inflation risks; on the other — labor market weakness. The chair gave no clear guidance on future actions, leaving markets uncertain. This means that the October Fed meeting could bring surprises — the rate may be cut, but a pause now looks just as likely.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.