The past week turned into a true carnival for investors: markets surged, indices hit new highs, and the tech sector once again showed who the main player is. Nasdaq gained 2.2%, the S&P 500 rose 1.2%, and the Dow Jones added 1%. Growth leaders — companies tied to AI, semiconductors, and innovation — proved that the future has already arrived.

Apple: iPhone 17 Ignites the Market

Apple keeps surprising. iPhone 17 sales exceeded expectations (covered here), the stock jumped 4.9%, and Wedbush analysts raised their target to $310. It seems the market has truly “come alive” — new smartphones, subscriptions, and services are creating a strong revenue stream. Investors appear ready to believe in Apple as much as fans believe in a new release.

Nvidia: At the Crossroads of Tech and Geopolitics

Nvidia is investing $5 billion in Intel, aiming to strengthen its position in the AI chip and data center segment. However, growing restrictions on chip exports to China are creating tension. On the one hand, demand for computing power is skyrocketing. On the other, external risks remind us that the tech market remains highly sensitive to global politics.

Micron: Earnings on the Horizon

Micron’s earnings report is due tomorrow, but the stock has already jumped 36% in September. The surge is driven by booming demand for AI chips, mobile devices, and servers. If the numbers beat expectations, next week could become a real fireworks show for the company’s shares.

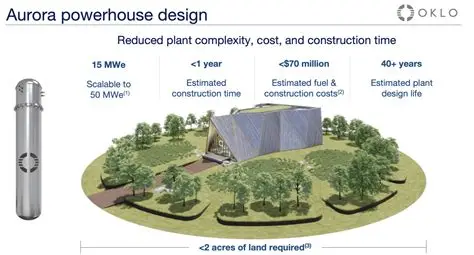

Oklo and IonQ: The Hype Around the Future

Companies in the niches of nuclear energy and quantum technologies keep surprising investors. Oklo and IonQ shares rose over 60% in a month. Investors expect breakthroughs, and each new report or announcement instantly impacts valuations. The future of technology is here and now — and those who enter in time could win big.

Risks: Overheated Nasdaq and Rising Bond Yields

But not everything looks rosy. Nasdaq shows signs of overheating, and rising bond yields remind us that a correction may be near. Investors should keep in mind that rapid growth can be accompanied by volatility and short-term losses. Portfolio protection strategies and close monitoring of key levels are more crucial than ever.

💡 The Key Question for Investors

A central dilemma is emerging in the market: lock in profits after the rapid rally or hold positions in hopes of further gains through the end of the year? The answer depends on your strategy, patience, and risk tolerance. One thing is clear: the chance to ride the wave of big profits exists, but it may disappear faster than it seems.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.