🏢 Bitcoin has again become the center of analysts’ debates. This time, a worrying forecast was made by Benjamin Cowen, founder of the analytical project Into The Cryptoverse. According to him, in the upcoming bear market, Bitcoin could lose up to 70% of its value. And although the expert emphasizes that such a scenario is not guaranteed, historical data makes one think.

Lessons from history: what happened before

Cowen reminds that every bear cycle of Bitcoin was inevitably accompanied by a massive crash.

- In 2011–2012, the cryptocurrency lost about 94% from its peak.

- In 2014–2015, the decline was approximately 87%.

- In 2018–2019, the drop reached 77%.

“Will it happen again? Nobody knows. But looking at the statistics of past cycles, ignoring such a possibility is like consciously closing your eyes to history,” Cowen warns in his YouTube video review.

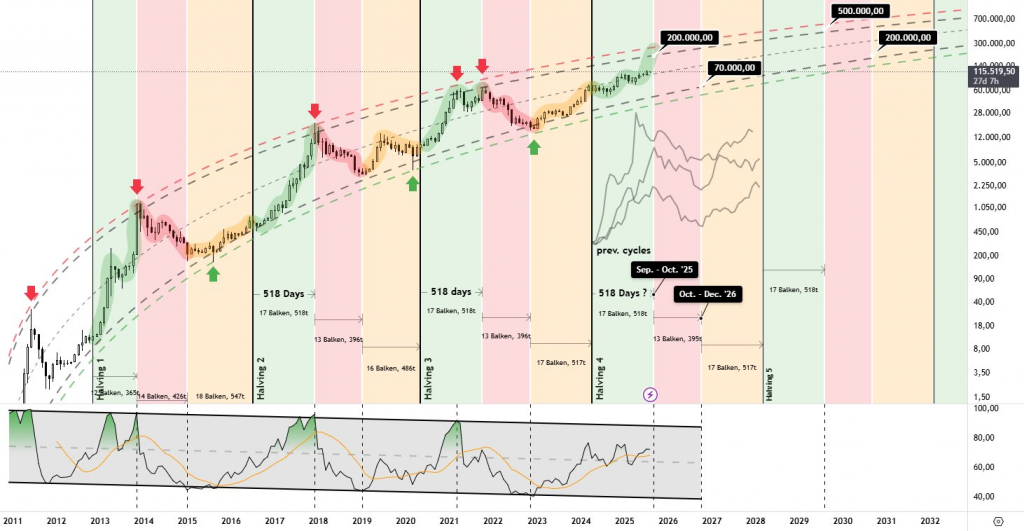

Bitcoin market cycle. Source: JDK Analysis

Possible levels: from $250,000 to $75,000

Today Bitcoin trades around $116,800. Some optimists expect a rally to $200,000–250,000 by the end of this year. But Cowen believes: the higher the rise, the more painful the fall could be.

A 70% drop after such growth would bring the first cryptocurrency back to around $75,000. For many investors, this will be a shock. But for those who have not yet entered the market, this scenario could become a “second chance.”

Final surge and moment of truth

According to the analyst, Bitcoin could reach its maximum much faster than most expect. “If a sharp rise begins in the fourth quarter, I won’t argue with the market. I’ll simply lock in profits and move into stablecoins,” Cowen admits.

His main thesis is simple: no one knows the exact moment of the peak. Even when the price breaks records, in real time it is impossible to understand that it is the top. Only after months or years does the chart become clear.

What should investors do?

Cowen shares his strategy: he is ready to wait out the market until mid-2026 before entering Bitcoin again. This approach assumes that the current cycle is close to ending. Over the past 12 months, BTC’s price has doubled — and this, according to the analyst, signals “overheating.”

1-month chart BTC/USD. Source: Bitstamp

Ethereum as the future leader?

The expert paid special attention to Ethereum. He predicts that in the coming weeks, ETH will continue to compete with Bitcoin for leadership. But ultimately, the second-largest cryptocurrency by market cap is capable of surpassing BTC by the end of the cycle.

Cowen notes that the ETH/BTC ratio has increased by 76% over the past 90 days. This indicator reflects how strongly Ethereum is strengthening compared to Bitcoin. “Ethereum will outperform Bitcoin throughout the remaining cycle,” the analyst is confident.

However, he expects temporary weakness for ETH in October.

1-day chart ETH/BTC. Source: Bitstamp

⚡ Conclusion

Cowen’s opinion sounds like a cold shower for those who believe only in endless growth. But his forecast fits the logic of cycles that the crypto market has gone through many times.

The question now is not whether there will be a correction, but how deep it will be. For some, it will be a painful test; for others — a chance to buy assets on sale. And history, as practice shows, rarely repeats in detail — but almost always rhymes.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.