📈 The U.S. stock market ended the day at new highs. All three key indexes reached historic records: Nasdaq gained 0.9%, S&P 500 rose 0.5%, and Dow Jones added 0.3%. Small-cap stocks stood out in particular: the Russell 2000 index jumped an impressive 2.5%, indicating growing investor interest in more risky segments of the market.

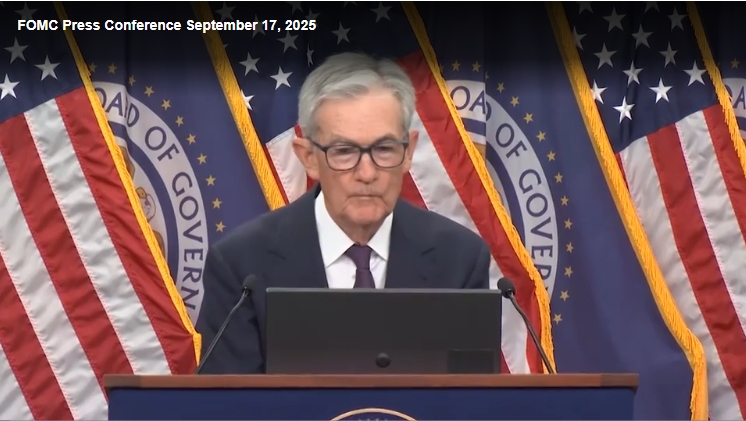

Main Growth Driver

The market was boosted by the Federal Reserve’s decision to cut the key interest rate for the first time in 2025 (as we reported here). Investors interpreted this as the beginning of a new monetary easing cycle. Moreover, expectations now include two more cuts before the end of the year, further fueling optimism and channeling capital into equities.

Heroes of the Day

- Intel surged 23% after striking a major deal with Nvidia. The companies announced joint chip development and a $5 billion investment.

- Nvidia gained 3.5%, further strengthening its position among tech sector leaders.

- Palantir rose 5%, breaking through a key technical level and receiving fresh buy signals.

- Spotify advanced 3.8%, approaching an important entry point for investors.

Overall Picture

The current market situation is marked by high activity: analysts recommend keeping 80–100% of portfolios in equities, while also reminding investors to lock in some profits. Nasdaq is currently trading 5% above its 50-day moving average, traditionally viewed as a sign of overheating and raising the probability of a short-term correction.

International Context

Asian markets initially followed the U.S. upward trend, but Japan unexpectedly turned lower. The reason was the Bank of Japan’s decision to begin large-scale sales of ETFs and real estate investment trusts (REITs), a negative surprise that could put pressure on global financial flows. At the same time, Chinese chipmakers rallied after announcements that they would stop purchasing Nvidia products, which the market interpreted as support for domestic producers.

Political Factor

Today, investors’ attention is focused on the expected phone call between Donald Trump and Xi Jinping. The agenda includes the fate of TikTok, trade negotiations, and a possible extension of the temporary tariff “truce.” The outcome of the dialogue could significantly influence stock market dynamics in the coming days.

💡 Takeaways for Investors

- Palantir and Spotify appear to be strong candidates for autumn favorites.

- The situation around the Trump–Xi call could set the tone for global markets in the near term.

- The Bank of Japan’s policy opens a new risk line — liquidity — which now requires close monitoring.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.