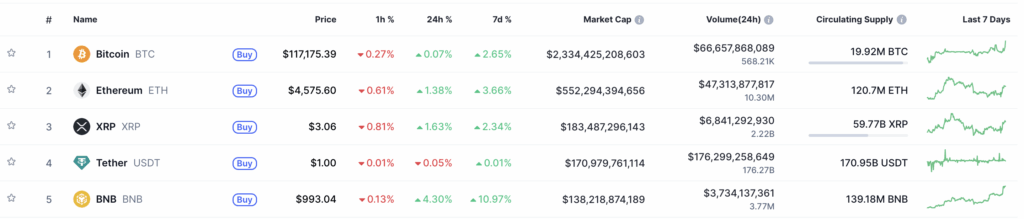

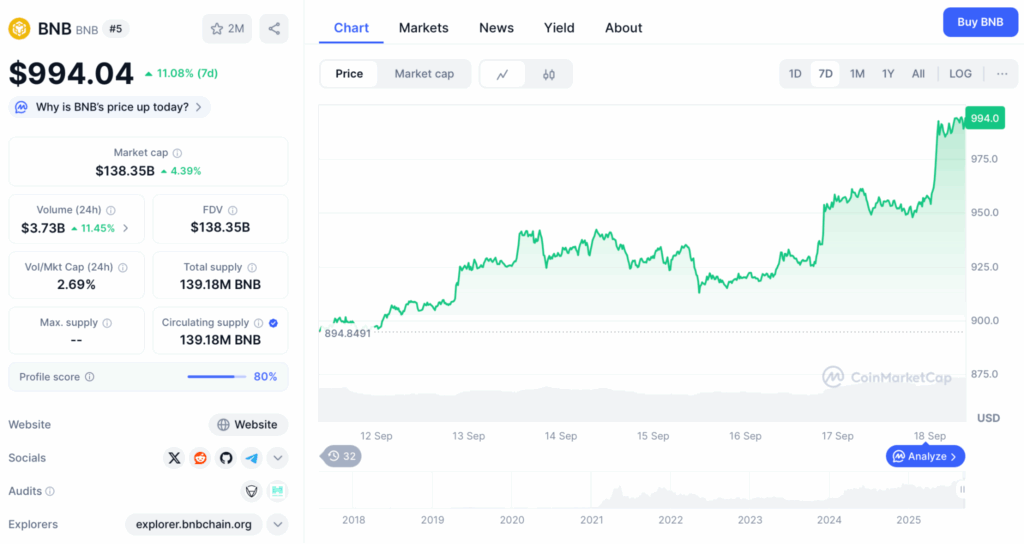

🚀 On September 18, 2025, BNB cryptocurrency surpassed the $1000 mark for the first time in history, setting a new all-time high and solidifying its place in the top 5 cryptocurrencies in the world by market capitalization. At the time of writing, BNB trades at $1002, with a market cap exceeding $138.35 billion, according to CoinMarketCap.

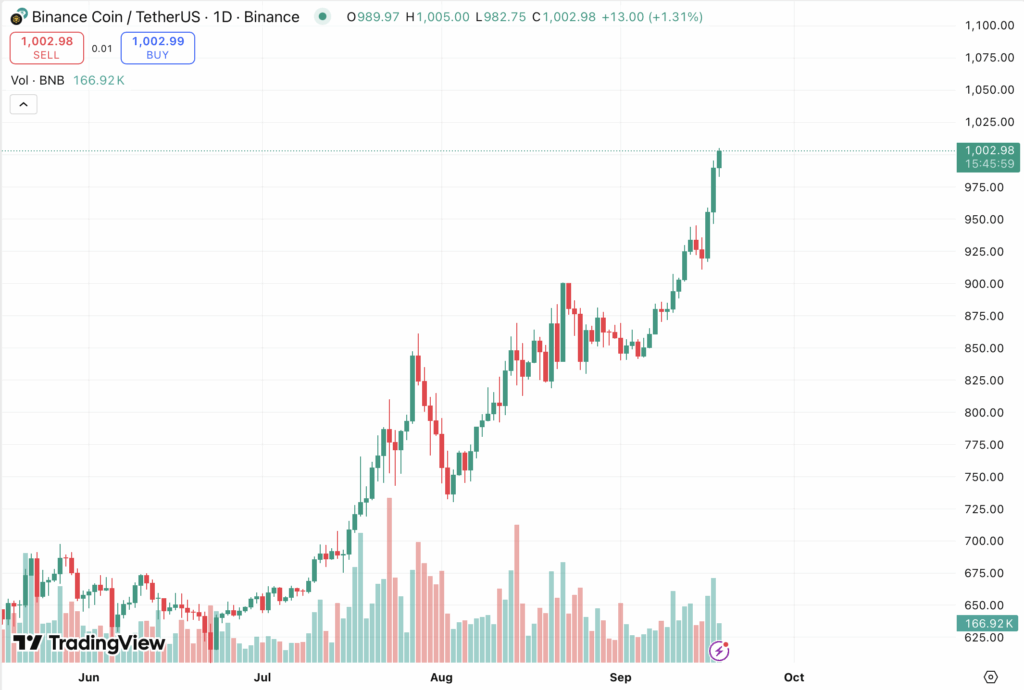

Daily BNB/USDT chart on Binance. Source: TradingView.

Growth Drivers: From the Fed to Binance News

Ranking of crypto assets by market capitalization. Source: CoinMarketCap.

Analysts attribute BNB’s rapid rise to several key factors:

- Fed rate cut — looser monetary policy traditionally boosts investor appetite for cryptocurrencies as inflation hedges.

- Binance and DOJ news — reports surfaced about the possible end of external monitoring of Binance, imposed under a plea agreement. This strengthened trust in the ecosystem tied to BNB.

As a result, daily trading volume exceeded $3.73 billion, up more than 11%.

BNB data. Source: CoinMarketCap.

The Road from $800 to $1000

Just two months ago, on July 23, 2025, BNB crossed the $800 mark for the first time. The trigger was Binance’s 32nd quarterly token burn, removing 1,595,599 BNB worth about $1.02 billion from circulation. This is part of a long-term program aimed at reducing supply — with more than 39 million coins still to be burned.

Token burns, as with Bitcoin halvings, traditionally create a shortage, boosting investor interest and supporting the price.

BNB Chain Tech Upgrades

In July, BNB Chain developers announced a major network upgrade:

These changes turn BNB Chain into one of the most scalable and competitive blockchain networks, capable of serving millions of users worldwide.

Institutional Drivers

The explosive growth of BNB was also fueled by major institutional initiatives.

- CEA Industries and 10X Capital, backed by YZi Labs, announced a $500 million PIPE and $750 million in warrants to create the world’s largest BNB reserve.

- CEA Industries also formed a $160 million corporate reserve, becoming the largest public company holding BNB.

- B Strategy unveiled a $1 billion fund to manage BNB reserves.

ETF — The Next Catalyst?

Markets are buzzing about the potential launch of the first U.S. spot BNB ETF. If approved by the SEC, trading could begin as early as November 9, 2025.

A BNB ETF could become a turning point for the asset: the instrument will provide institutional and retail investors with legal access to BNB through traditional stock exchanges.

📌 Conclusion

BNB didn’t just set a new all-time high — it secured its status as one of the key players in the crypto market. A combination of factors — from Fed macroeconomic decisions to technological upgrades and institutional demand — made the rise above $1000 a natural stage of its development.

BNB didn’t just set a new all-time high — it confirmed its role as a key player in the crypto market. Analysts suggest the next target could be $1500 and beyond.

You can watch the video presentation in our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.