📊 The U.S. Federal Reserve cut the key interest rate by 25 bps — from 4.50% to 4.25%. This decision matched analysts’ forecasts, although some market participants had expected more decisive action.

After the meeting, Fed Chair Jerome Powell held a press conference where he outlined key problems of the U.S. economy and explained why the regulator is acting with such caution.

Economic situation: growth slowing, inflation high

According to Powell, inflation has accelerated again and remains at a fairly high level, which continues to worry the regulator. The main driver of price growth this year has been goods, and additional pressure is expected from previously introduced tariffs. Their effect on prices will manifest not only this year but also next year.

Meanwhile, GDP growth has slowed, largely due to weaker consumer spending. Households have become more cautious in their spending, reflecting both rising prices and the gradual depletion of savings accumulated during the pandemic.

Labor market: resilience in question

Although unemployment remains low, Powell noted that he can no longer describe the labor market as fully stable. Job growth has slowed, and with it, risks of reduced employment have increased.

An interesting emphasis was placed on the role of technology: artificial intelligence (AI), according to Powell, may be one of the reasons for slower hiring, as companies increasingly automate processes.

Monetary policy: caution over drastic moves

Powell described the 25 bps rate cut more as a risk-management tool than as a decisive factor for the economy.

- A 50 bps cut did not receive broad support within the committee.

- 10 out of 19 FOMC members project two or more rate cuts by year-end, while the remaining 9 expect fewer.

- Powell stressed: “I do not see the need to cut rates quickly.”

Thus, the regulator will act gradually, weighing inflation risks against economic support.

Real estate market and Fed reserves

Powell separately noted that significant changes in interest rates would be needed for Fed decisions to have a visible impact on the housing market. For now, this sector remains relatively unaffected by current adjustments.

As for the financial system as a whole, Fed reserves remain abundant, and balance sheet reduction, according to Powell, is proceeding at a fairly modest pace.

Tariffs and political risks

The Fed takes into account the effects of tariffs, but Powell expects their impact on inflation to be short-lived. At the same time, he emphasized that Fed decisions will not be driven by political considerations.

📌 Conclusion

The U.S. economy is not in bad shape, Powell stressed. However, risks are rising — both for inflation and for the labor market.

- Rate now: 4.25% (-0.25%)

- Forecast: 4.25%

- Previous: 4.50%

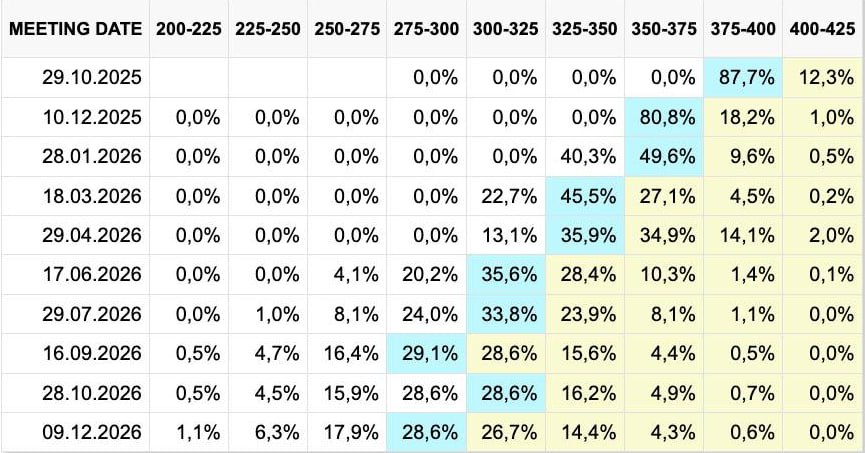

Fed rate forecasts

Analysts expect the regulator to continue the easing cycle:

- October 29 — cut by 25 bps to 3.75–4.00%

- December 10 — cut by 25 bps to 3.50–3.75%

- January 28, 2026 — pause

- March 18, 2026 — cut by 25 bps to 3.25–3.50%

- April 29, 2026 — pause

- June 17, 2026 — cut by 25 bps to 3.00–3.25%

- July 29, 2026 — pause

💡 For markets, this is a signal: the Fed is ready to ease policy, but will do so very cautiously. Quick and aggressive moves should not be expected.

👉 Official FOMC meeting broadcast

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.