🕒 This year, the crypto world once again demonstrated how easily investors’ emotions can be exploited against them. At the center of the scandal was the token “120 HOURS”, launched by a man with a disability who claimed he had only 120 hours left to live. Promising honesty and transparency, he convinced people to buy the coin – and in just a few hours raised over $500,000 before disappearing along with the funds.

How it happened

The token was launched on September 16 at 5:35 a.m. on the Solana blockchain and appeared on several crypto exchanges, including Bitged.

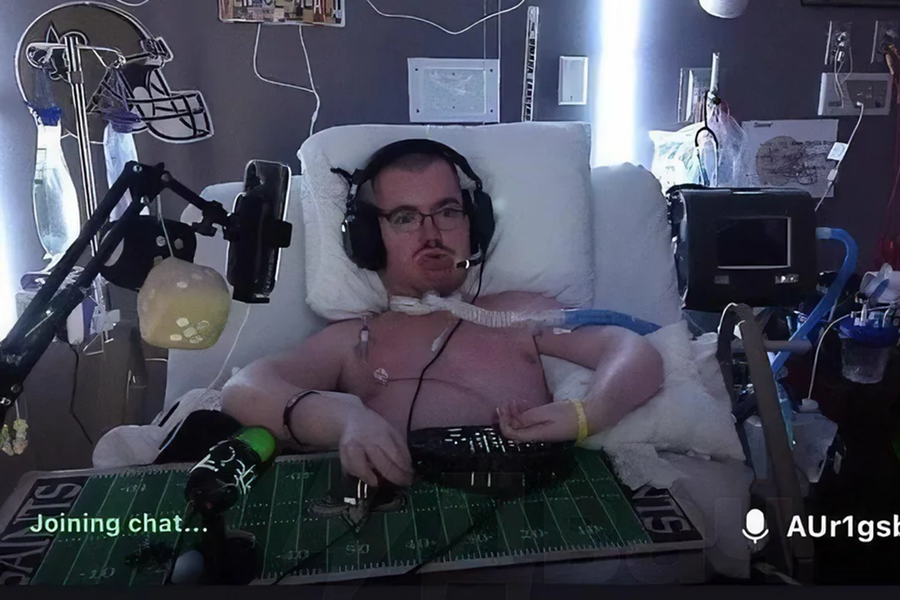

The project’s creator presented himself as a terminally ill streamer lying in bed and claiming his hours were numbered:

“The 120 HOURS project appeared thanks to a streamer who was bedridden, claiming he had only 120 hours to live. He stated that the earnings from transaction fees with the token would go to his family after his death”, the token’s description read.

Many investors took this emotionally, seeing the coin as an opportunity not only to help a person but also to make a quick profit. In the first hours, the token price jumped from $0.00006348 to $0.0004686, nearly a 7x increase, and the project’s market cap approached $500,000. However, within minutes, all the funds were withdrawn, and by 9:00 a.m. the price had crashed to $0.000008215.

Consequences for investors

After the collapse, the creator vanished. Streams stopped, communication on social media and with investors ceased. Users began actively discussing the incident on Reddit, Twitter, and in crypto communities, speculating that the man had taken all the funds.

The case sparked debate: was the creator truly terminally ill, or was his story a carefully staged performance designed to manipulate emotions? In any case, the investors’ money disappeared faster than the promised 120 hours, turning the token into a symbol of one of 2025’s loudest scams.

Why it happened

- Emotional manipulation: the story of a dying man acted as a trigger.

- FOMO (Fear of Missing Out): the rapid price increase pushed investors to jump in.

- Lack of verification: no one checked the creator’s health or intentions.

Risk analysis

- Instant profits = instant losses.

- Lack of regulation: Solana and other blockchains allow projects to launch without identity checks.

- Social factor: people trust “real-life stories” rather than facts.

Investor takeaways

- Always verify information.

- Evaluate the team and the project.

- Be cautious with hype-driven tokens.

- Social factor: people trust “real-life stories” rather than facts.

Conclusion

The “120 HOURS” case is a vivid example of how easily trust can be manipulated in the crypto world. One emotionally savvy individual managed to raise half a million dollars in just a few hours by using only his “story of illness and limited time.”

This story went viral, was widely discussed on social media and forums, and unfortunately left many investors with losses. The lesson is clear: in the crypto world, trust and emotions can be costly, while caution and fact-checking are your best shield.

💡 Moral: Even the most touching stories are not a reason to invest. In crypto, analysis, strategy, and common sense matter most.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.