⚔️ Companies and governments continue to actively build up their cryptocurrency reserves. U.S. Senator Cynthia Lummis has introduced a bill requiring the U.S. Treasury to acquire 1 million BTC within five years for the federal reserve. In March 2025, former President Donald Trump announced the creation of a Strategic Bitcoin Reserve, funded by cryptocurrencies confiscated by the U.S. Treasury.

This trend reflects the growing interest in digital assets as a tool for strategic capital management — both at the corporate and governmental level.

Why Corporations Choose Cryptocurrency Reserves

Traditionally, corporate reserves consisted of fiat money, gold, and government bonds to preserve value and ensure liquidity. However:

- Fiat loses purchasing power due to inflation.

- Bonds carry interest rate and market risks.

- Currency shocks can suddenly hit the balance sheet.

Today, Bitcoin, Ethereum, and stablecoins are positioned alongside traditional assets. The main objectives for corporations:

- Hedge against inflation.

- Diversify currency risks.

- Maintain 24/7 liquidity.

- Test digital settlements.

For governments, the range of objectives is broader:

- Establish strategic reserves.

- Increase resilience to sanctions.

- Access neutral global liquidity.

Bitcoin — Digital Gold 🪙

Since its inception, Bitcoin has held a unique position as the first and most well-known cryptocurrency. It attracts reserves aiming to protect against inflation and traditional currency risks.

Examples:

- El Salvador created a sensation in 2021 by adopting BTC as legal tender.

- Countries like Bhutan quietly included Bitcoin in their reserves.

- In the corporate world, Strategy continuously acquires BTC, making it a primary reserve asset.

Advantages of Bitcoin:

- Highly liquid due to global markets.

- Scarce due to limited supply.

- Widely recognized in the financial world.

Yield characteristics: to generate profit from idle BTC, it often needs to be combined with external lending or derivative strategies.

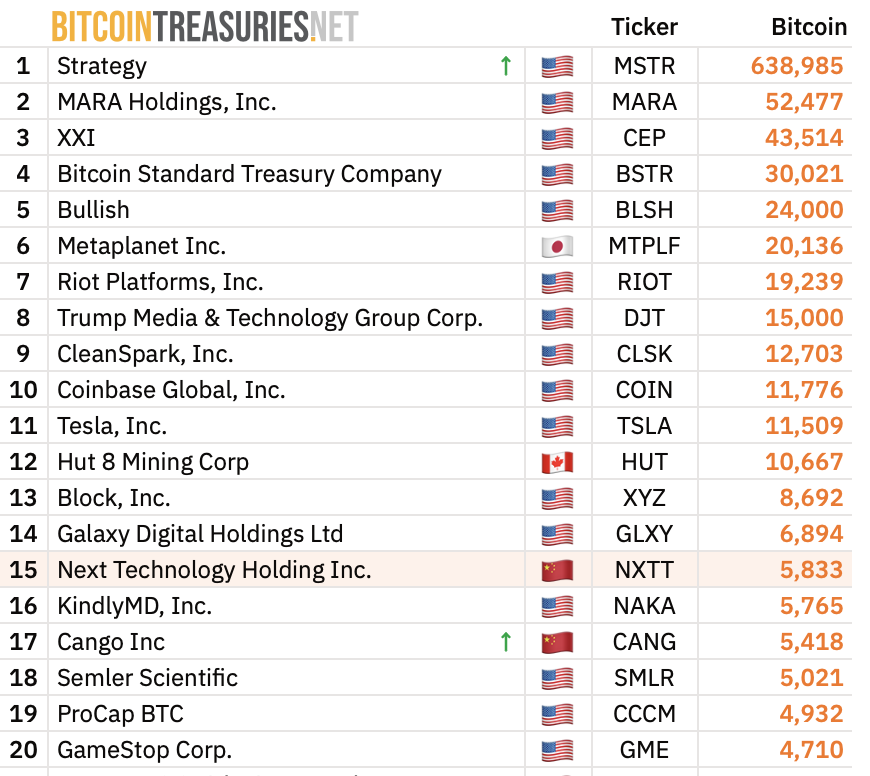

Statistics as of September 16, 2025:

Top-20 corporate Bitcoin holders. Source: Bitcoin Treasuries

- Strategy controls approximately 638,985 BTC worth billions of dollars.

- The number of public companies holding BTC increased from 70 in December 2024 to 134 by mid-2025, accumulating nearly 245,000 BTC.

Ethereum — A Programmable Alternative

Although Bitcoin remains the cornerstone of reserves, Ethereum became an attractive alternative after switching to the proof-of-stake algorithm (The Merge) in 2022.

Advantages of ETH:

- Reduced energy consumption.

- Staking introduced, yielding 3–5% annually.

- A productive asset, unlike BTC.

The Ethereum ecosystem adds value:

- DeFi allows liquidity without selling assets.

- Tokenized real-world assets (bonds, commodities) strengthen Ethereum’s role as a financial platform.

- Companies and DAOs use ETH as a reserve for long-term stability.

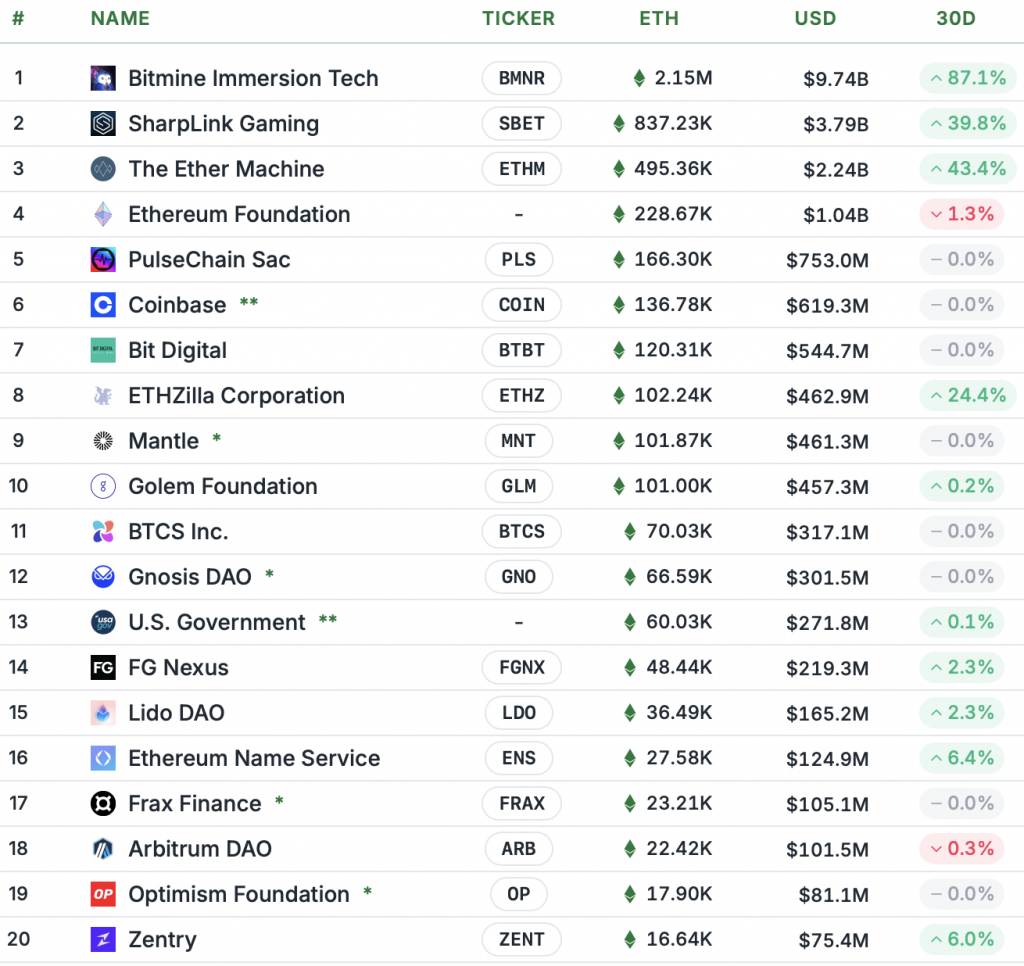

Statistics as of September 16, 2025:

Top-20 corporate Ethereum holders. Source: Strategic ETH Reserve

- 71 holders had 4.91M ETH worth $21.28B.

- Bitmine Immersion Tech (BMNR) is the largest holder with 2.15M ETH (~$9.74B).

Dual Strategy: BTC + ETH

Some governments and corporations have started combining both assets:

- BTC provides stability and global recognition.

- ETH generates yield and supports a growing tokenized asset ecosystem.

Examples:

- The U.S. federal government created a strategic crypto reserve: 198,000–207,000 BTC ($17–20B) through seizures and other sources.

- U.S. digital asset vault for altcoins: about 60,000 ETH, valued at $261M (according to Arkham Exchange’s analysis of government addresses).

- BitMine Immersion Technologies holds 192 BTC and simultaneously 2.15M ETH (~$9.74B).

Who Wins in 2025?

The competition between BTC and ETH highlights their unique strengths:

| Asset | Advantages | Use Purpose |

|---|---|---|

| Bitcoin | Stability, trust, global recognition | Capital preservation, liquidity |

| Ethereum | 3–5% yield, DeFi, asset tokenization | Growth, income generation, participation in financial ecosystem |

💎 Conclusion:

The choice between BTC and ETH depends on objectives:

- BTC is suitable for long-term value storage and liquidity.

- ETH attracts with yield and practical utility.

Most likely, the future of corporate and government reserves will combine both assets — Bitcoin’s stability and Ethereum’s yield — setting new standards for strategic cryptocurrency reserves.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.