🏛️ Only a few days remain until the U.S. Federal Reserve meeting. Investors and analysts are actively discussing the likelihood of a rate cut. The consensus forecast points to at least a 0.25 percentage point decrease. However, the key question is whether the market has already priced this in, and whether it is reflected in the current price of bitcoin.

Last week, inflows into U.S. spot ETFs for bitcoin and ether became one of the main supporting factors for the crypto market. For five consecutive trading days, funds recorded net inflows: bitcoin ETFs attracted $2.34 billion, while ether funds added another $638 million. This is a substantial amount, confirming institutional interest and investors’ willingness to increase their share of crypto assets in portfolios.

Nevertheless, bitcoin faces a strategic challenge: breaking above $117,000. Otherwise, there is a high probability of consolidation within a range with a lower boundary near $112,000. Such a sideways corridor could persist if macroeconomic drivers prove weaker than the market expects.

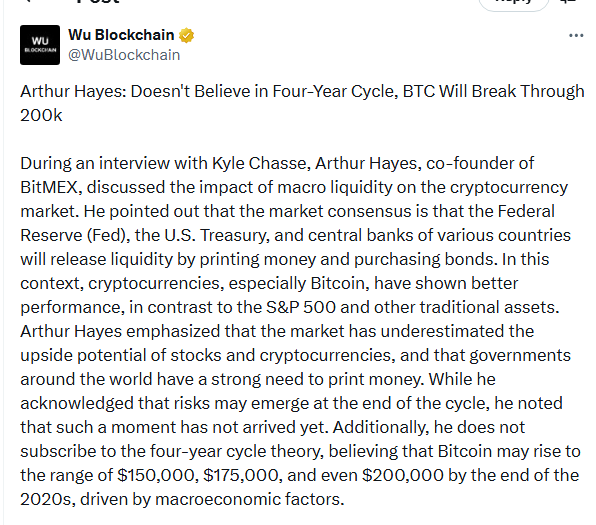

Arthur Hayes, one of the most prominent figures in the crypto industry, continues to argue that the traditional four-year bitcoin cycle is no longer relevant. According to his forecast, growth will continue up to $200,000, although he clarifies that this is more of a long-term scenario through 2030 rather than a short-term impulse.

In an interview with Kyle Chasse, Hayes discussed the impact of macroeconomic liquidity on the cryptocurrency market. He noted that market consensus holds that the Federal Reserve, the U.S. Treasury, and central banks in various countries will release liquidity through money printing and bond purchases. In this context, cryptocurrencies, especially bitcoin, have shown better performance compared to the S&P 500 and other traditional assets.

Arthur Hayes emphasized that the market underestimates the growth potential of stocks and cryptocurrencies, while governments around the world have a strong need to print money. At the same time, he acknowledged that risks may emerge at the end of the cycle but noted that such a moment has not yet arrived. Furthermore, Hayes does not subscribe to the four-year cycle theory, believing that bitcoin could rise to $150,000, $175,000, or even $200,000 by the end of the 2020s, driven by macroeconomic factors.

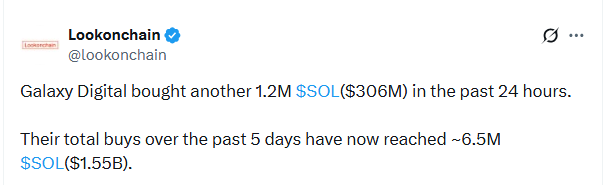

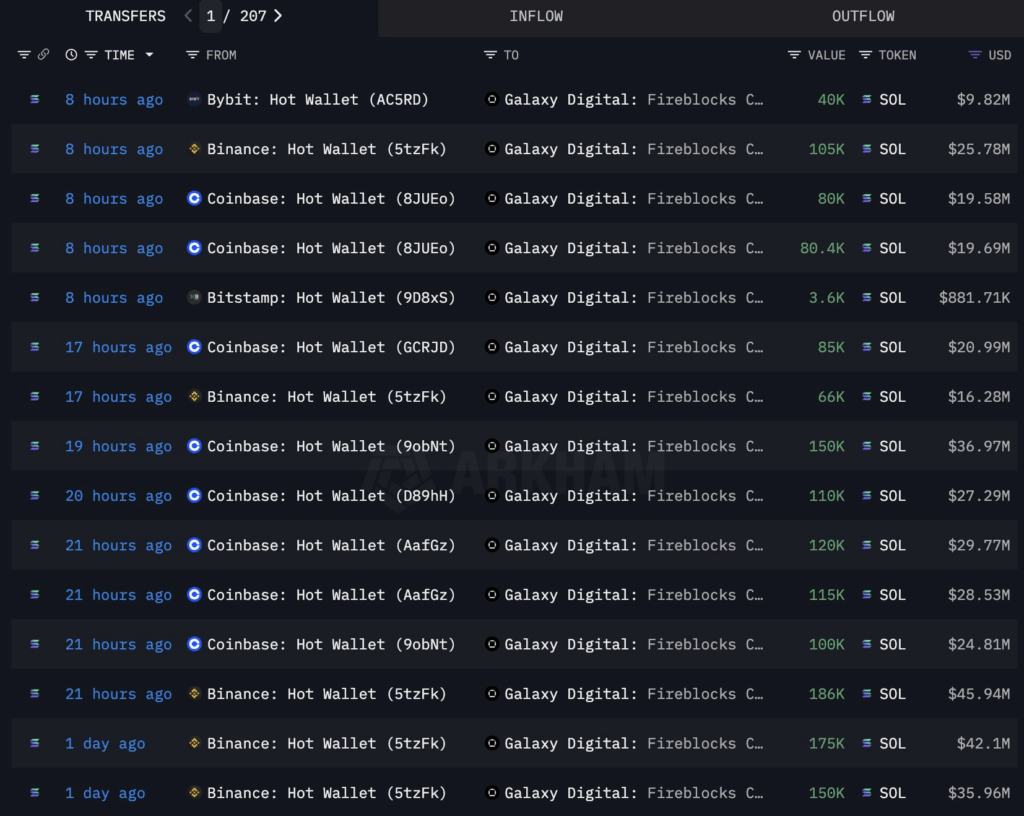

Institutional players’ activity in altcoins also deserves attention. Over the past five days, Galaxy Digital increased its Solana holdings by $1.55 billion, including an additional $306 million purchase in the latest round. Against this backdrop, it becomes clear that SOL currently remains one of the main contenders for the role of the market’s “locomotive.”

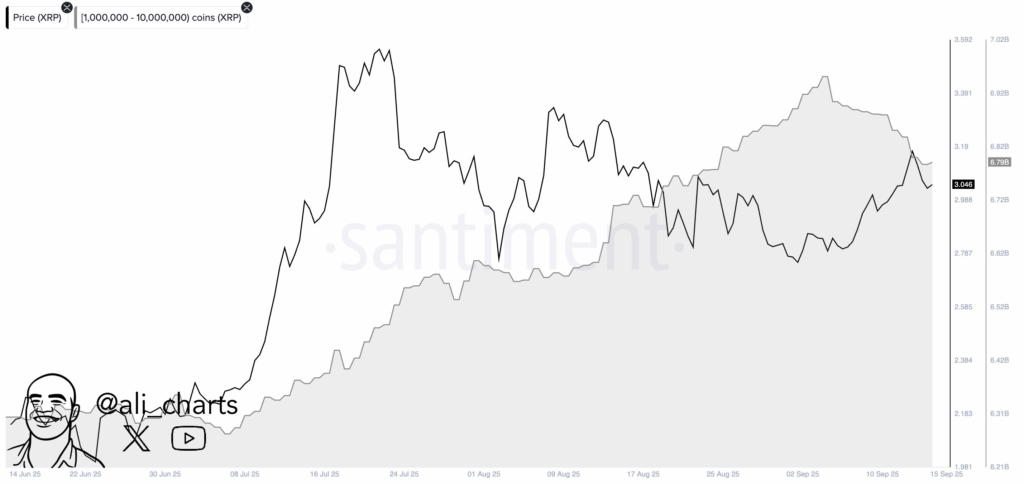

A completely different dynamic is observed with XRP: large holders have reduced their positions by $160 million over the past two weeks. This unloading by whales is putting significant pressure on the price and explains why traders and investors are increasingly shifting their focus to Solana.

Meanwhile, the regulatory agenda remains tense, but there are also positive signals. The U.S. Securities and Exchange Commission (SEC) announced its willingness to soften its approach toward crypto companies, promising to first issue warnings to market participants about possible violations before imposing penalties. For the industry, this could be an important step toward greater predictability and reduced regulatory risks.

📦 Thus, the upcoming Fed meeting will be a defining event for the crypto market in September. How the market perceives the rate decision — as a new impulse or as a factor already priced in — will determine the further trajectory of bitcoin and other key assets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.