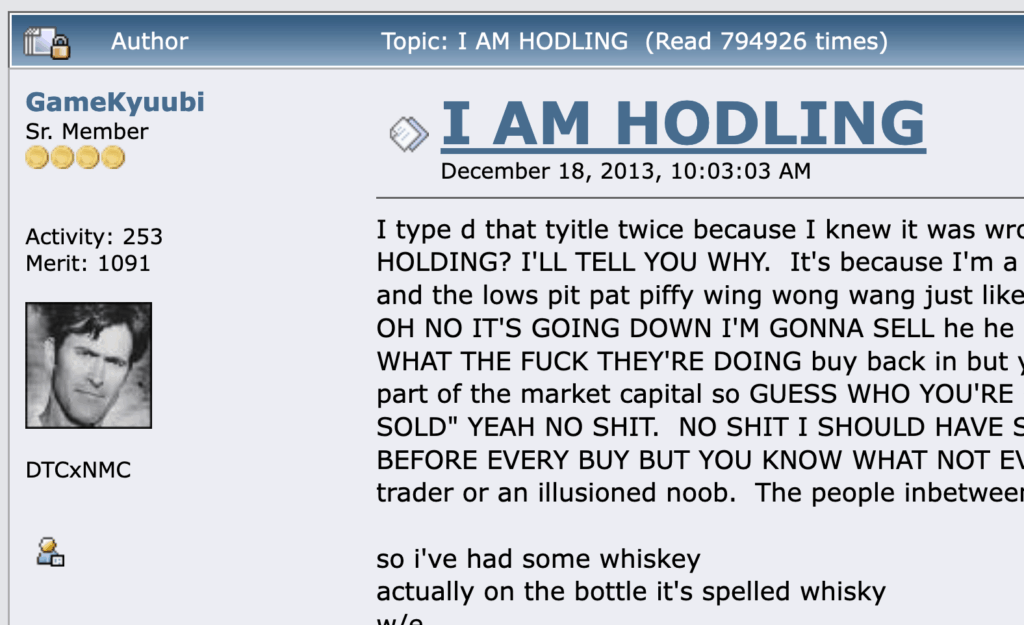

🔴 It all began in December 2013. A user named GameKyuubi, slightly “under the influence” of whiskey (most likely!) and frustrated by Bitcoin’s 39% drop in a single day, posted the now-famous thread on Bitcointalk titled “I AM HODLING.” He intended to write “holding,” but hit the wrong keys. What seemed like a random typo actually created a legend.

Since then, “HODLing” has become the symbol of a strategy where investors buy Bitcoin and simply hold it, no matter how turbulent the market gets.

Why HODLing works

The crypto market is not a walk in the park but a roller coaster, where the cars sometimes drop 20% in a single day. Naturally, beginners panic: sell before it’s too late, or buy more “on discount”?

HODLers ignore these emotions. They have “diamond hands.” They know the real threat isn’t volatility but panic. As Nobel laureate Daniel Kahneman showed, the pain of losses is felt about twice as strongly as the joy of equivalent gains. That’s why the “buy and hold” strategy is not just investing — it’s also managing one’s own psychology.

2025: Bitcoin as a store of value

Today, Bitcoin is no longer seen as just a “toy for geeks.” Fidelity, BlackRock, and other giants include it in reports alongside gold. And the numbers speak for themselves: over 70% of all Bitcoin hasn’t moved in more than a year — a record high.

If you survived the FTX collapse, market crashes, and inflation swings, then 2025 shows that Bitcoin not only endured but strengthened its role as digital “gold.” In August, it hit a new all-time high above $124,000.

Institutions on the side of HODLers

The main growth driver has been institutional capital. BlackRock’s IBIT ETF now holds over 3% of all Bitcoin, while U.S. spot ETFs collectively manage over $94 billion in assets.

This means that HODLing Bitcoin today is not a lonely walk but a strategy shared by the world’s largest players.

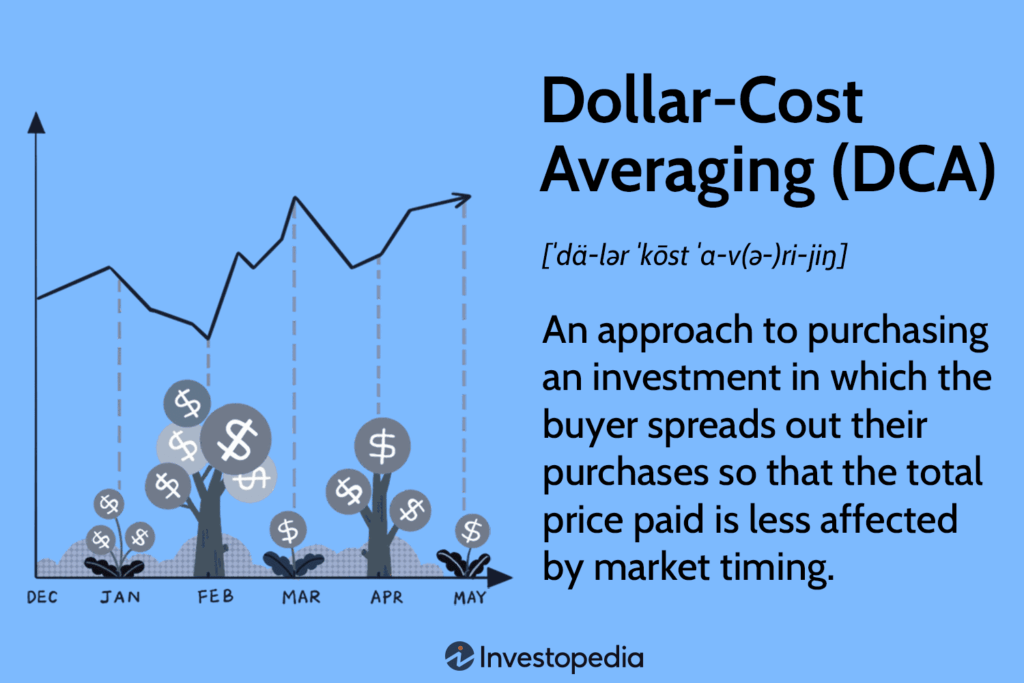

DCA: the HODLer’s ally

HODLing rarely means “buy once and wait 10 years.” Most investors use DCA (Dollar Cost Averaging) — making regular purchases of fixed amounts.

Example: $100 in BTC every week. At the peak you buy fewer coins, at the dip you buy more. The result: you don’t try to “catch the bottom,” you average out your entry price and reduce the impact of volatility.

DCA perfectly complements HODLing — discipline over emotions, strategy over guessing.

Tools for 2025

If HODLing once meant hiding a seed phrase on a piece of paper under your mattress, today it’s much more advanced.

- Cold wallets: Ledger, Trezor, Ellipal Titan — the classics for long-term storage.

- Custodial services: Fidelity Digital Assets, Coinbase Custody, BitGo — for those who trust institutions.

- Auto-purchases: Swan Bitcoin, River Financial, Strike enable automated DCA.

- New opportunities: even staking services now offer BTC-based products (wrapped and derivative tokens).

Here, by the way, you can get legendary hardware wallets for beginners with all the basic features!

Challenges ahead

It would be naïve to think the path forward is only upward.

- Regulation: countries are discussing capital controls on crypto.

- CBDCs: central bank digital currencies are reshaping the landscape.

- Competition: tokenized U.S. Treasuries with >5% yield are already available on-chain.

Yet even with these challenges, Bitcoin remains at the heart of the digital financial system.

💡 Conclusion: philosophy over emotions

From a typo to a global strategy — that’s the journey of HODLing. In 2025, it’s not just a meme but a time-tested model for preserving capital.

The key principles are simple:

- don’t panic during drops,

- don’t get greedy during rallies,

- trust discipline over emotions.

That’s why HODLing remains the most widespread and successful strategy in the crypto world.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.