🔴 Beginner’s Guide

The crypto market has gone mainstream, attracting streams of new investors. The profit potential is impressive, but the risks are also significant. To start safely and effectively, it is important to understand the key principles of investing and trading in the crypto industry.

Start with a reputable centralized exchange

Your first step into cryptocurrency usually begins with a centralized exchange, where you buy your first coins and get familiar with trading tools. Choosing an unreliable platform can cost you everything, even if you make no mistakes as an investor.

Key factors when choosing an exchange:

- Liquidity — the higher the trading volume, the faster orders are executed and the lower the spread.

- Security — have there been hacks? Are there compensation policies for users?

- Regulation — does it have licenses in your region or major jurisdictions?

- Community trust — check reviews on forums and social media (X/Twitter, Telegram, Reddit).

Choose a platform that provides reliable trade execution, transparent fees, and customer support.

Start with a small capital

The most common mistake beginners make is entering the market with a large amount, expecting quick profits. Cryptocurrency can generate significant returns, but it is also one of the most volatile markets in the world.

Cryptocurrency can generate huge profits, but it is also one of the most volatile markets in the world.

Practical approach:

- Start with an amount you are willing to lose without serious budget impact.

- Use this capital for learning: explore the exchange interface, wallets, and trade execution.

- Gradually increase your investment as you gain experience and confidence.

Treat your initial capital as a learning expense — the cost of acquiring skills.

Continuous learning

Knowledge is your main advantage in the crypto market. The industry evolves at incredible speed: technologies, regulations, and trends change weekly.

Where to learn:

- Trusted sources: analytics platforms, independent research, educational crypto materials (Messari, The Block, Delphi Digital)

- Expert opinions: social media, specialized blogs, channels with quality reviews

- DYOR (Do Your Own Research) — verify all claims, analyze projects yourself, don’t rely on one person’s opinion

Only active learning can help reduce the risk of losing funds due to unverified information.

Security tips:

Cryptocurrency is not only an investment but also a target for hackers. Even a small mistake with a seed phrase or wallet can cost your entire portfolio.

Asset protection

- Trade on verified and secure platforms

- Store seed phrases offline; never save them digitally

- Enable two-factor authentication (2FA) and secure your email

- Don’t connect wallets to unverified dApps or smart contracts

- Use monitoring tools to track approvals (e.g., Arkham, DeBank)

- Use hardware wallets for large amounts

Your vigilance is the best protection against scammers. Here, by the way, you can get legendary hardware wallets for beginners with all the essential features!

Capital management

Surviving in the crypto market is more important than making quick profits. Before diving into complex strategies, learn proper risk and capital management.

Basic rules:

- Don’t put everything on one coin — diversification is essential

- Avoid high leverage (>10x) — most beginners lose money at this level

- Set stop-loss and take-profit orders to minimize emotional trades

Smart capital allocation:

- 50–70%: blue-chip assets (BTC, ETH, other proven assets)

- 20–30%: mid-tier projects (DeFi, infrastructure tokens, Layer 2 projects)

- 10%: high-risk plays (meme coins, new tokens, hype trends)

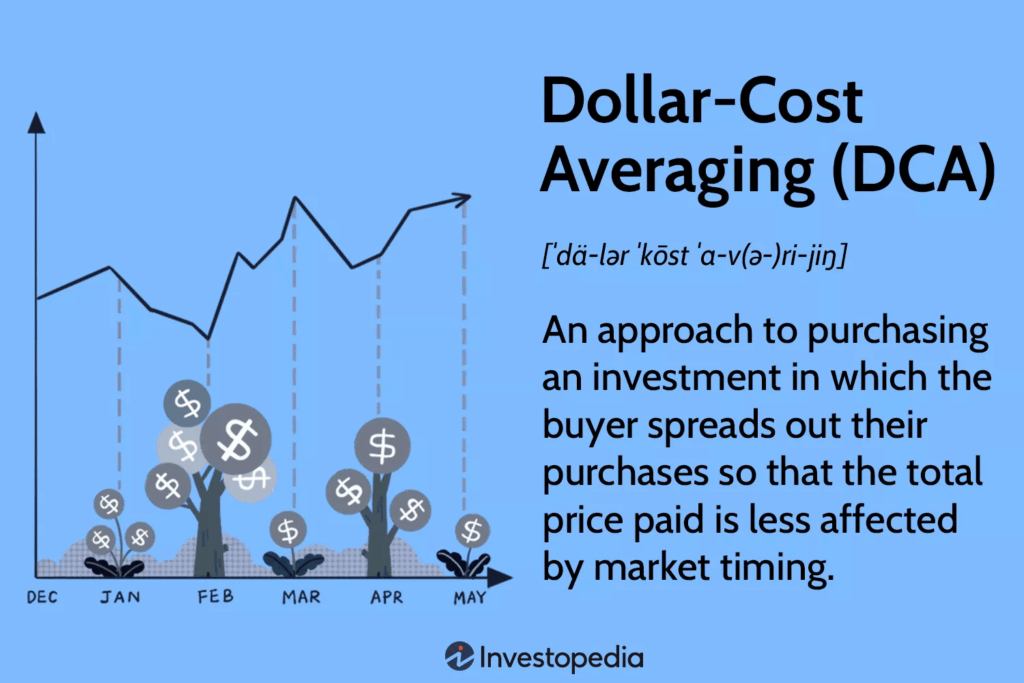

DCA and HODL

Dollar-Cost Averaging (DCA) — a safe strategy for beginners.

Buying a fixed amount regularly reduces the impact of volatility. Example: buying $100 every week in BTC. In 2–3 years, nearly guaranteed profit regardless of short-term fluctuations.

Keeping an investment journal

Record reasons for purchase, target price, portfolio share allocated to the asset. Analyzing past decisions helps identify mistakes and improve strategy.

Additional beginner tips:

- Start with simple assets and gradually explore DeFi, NFTs, and other trends

- Monitor regulations in your country

- Use bonus programs and educational resources on your chosen platform to build skills without risk

💡 Conclusion

The crypto market is a world of opportunities and risks. Most beginners lose money not due to lack of potential but due to insufficient preparation and poor capital management.

Following these principles (reputable exchange, small starting capital, continuous learning, asset protection, proper capital management) will shorten your learning curve and protect you from common mistakes.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.