✈️ The situation surrounding Boeing continues to attract the attention of investors and analysts.

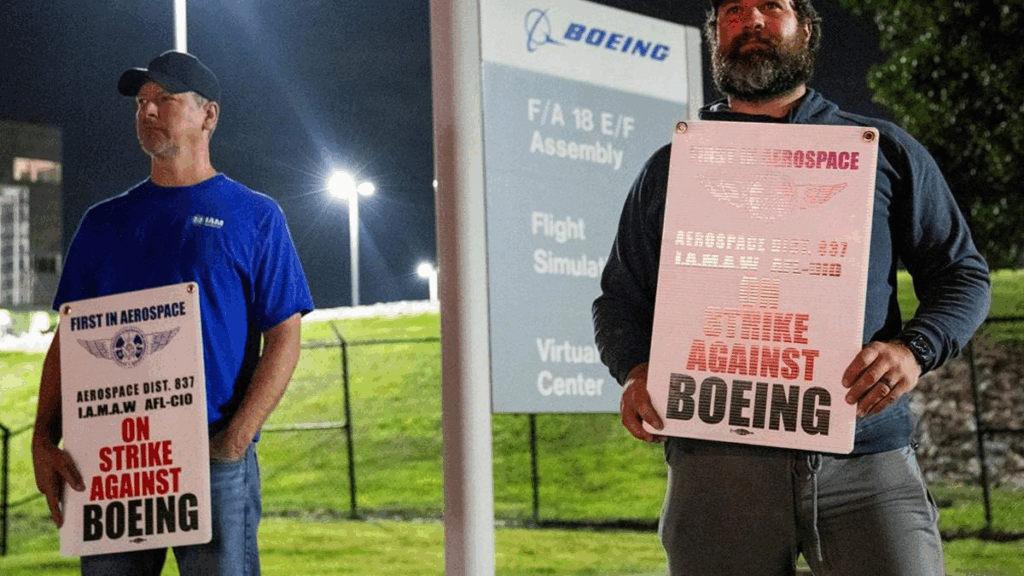

Members of the Missouri defense division union have rejected a new labor contract and have been on strike since August 4. The proposal included a 45% salary increase over five years and a $4,000 bonus, but the union representatives called it a “half-measure” and are demanding more substantial terms.

These developments directly impact the company’s production processes. Manufacturing and assembly of military equipment, including F-15 and F/A-18 fighter jets, are slowing down. Additionally, certification of the wide-body 777X aircraft is delayed, which may affect Boeing’s plans to bring planes to market and secure new contracts.

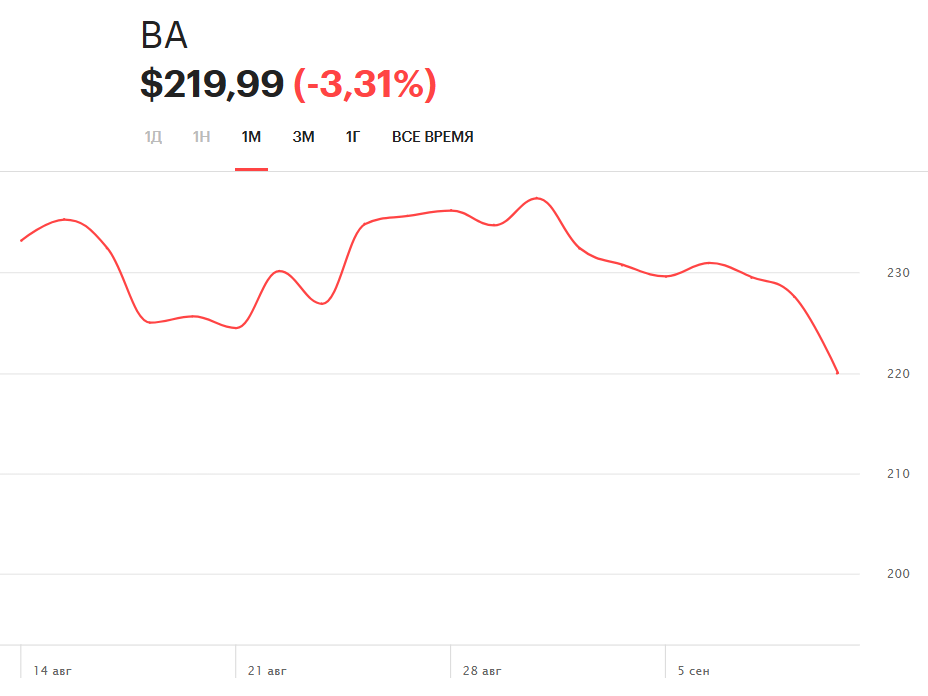

The financial market reaction was immediate. On Friday, Boeing shares fell 1.7% and broke below the 50-day moving average — a technical signal that concerns short-term investors and indicates the potential for further price declines in the near term.

What investors should know:

Short-term: there is a risk of further decline due to uncertainty in negotiations and possible production impacts.

Medium-term: Boeing remains a major player in both defense and commercial aviation, holding large contracts and an order backlog. Technical analysis shows that shares are trading near 242, considered a potential entry point; a breakout with volume could signal a buying opportunity but requires caution.

Boeing stock status in real time:

Share price on 05.09.2025 — $219.99 (source)

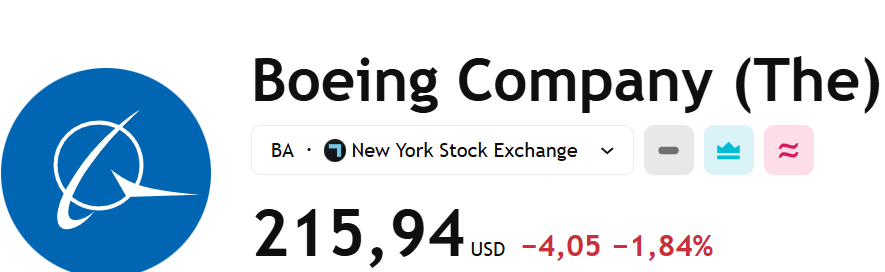

Share price on 13.09.2025 — $215.94 (source)

💡 Conclusion:

The situation remains tense, and investors should closely monitor negotiations between the union and Boeing management. Any changes to labor agreements or resumption of production could significantly impact stock performance. In the current environment, caution and a balanced investment approach are especially important.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.