📈 BNB surprises investors again, surpassing the $900 mark. The surge coincided with the release of fresh U.S. core inflation data — the indicator came in below expectations, reducing fears of aggressive monetary tightening. Positive macroeconomic statistics boosted investor confidence and drove growth in cryptocurrencies, especially those actively integrated with traditional financial structures.

A partnership that mattered

One of the key factors was the recent strategic partnership between Binance and the international investment company Franklin Templeton. As we previously reported, the collaboration focuses on joint development of initiatives in digital assets, including:

- Tokenization of securities — creating digital versions of traditional assets to enhance transparency and efficiency.

- Development of investment products for institutional investors with integrated yield and settlement.

- Integration of traditional and digital markets, paving the way for broader institutional adoption of crypto assets.

The partnership adds institutional credibility to BNB, increasing investor trust in the Binance ecosystem and creating favorable conditions for token growth.

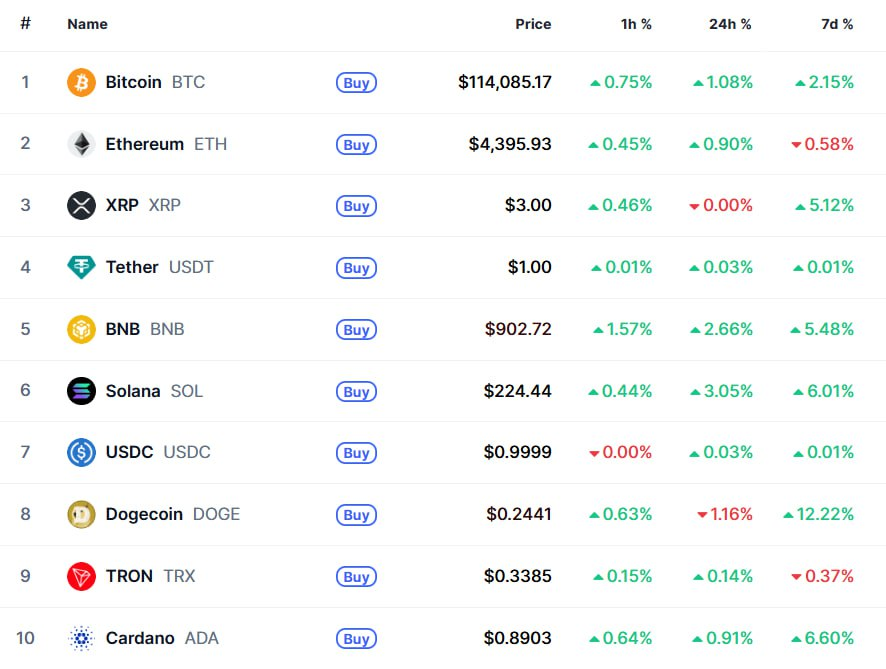

Top-10 cryptocurrencies by market capitalization. Source: CoinGecko.

Macroeconomics and the crypto market

Why BNB is rising:

- Positive macroeconomic data in the U.S. reduced inflation fears and encouraged investors to seek yield in crypto assets.

- The partnership with Franklin Templeton added institutional credibility to BNB and the entire Binance ecosystem.

- Trading activity on major exchanges and growing interest in tokenized products strengthen demand for the token.

BNB’s rise coincided with positive macroeconomic signals:

- U.S. inflation below forecasts — investors lower expectations for Fed rate hikes.

- Stock indices rising — BNB and other major cryptocurrencies often correlate with equity trends.

- Demand for tokenized products — institutional investors seek new diversification tools.

Forecast and potential

Analysts note that the combination of favorable macroeconomics and institutional initiatives creates a strong momentum for BNB and other cryptocurrencies.

“Our partnership with Binance will enable us to launch innovative products that meet the rigorous standards of global capital markets and jointly develop next-generation investment portfolios,” said Roger Beyston, Executive Vice President of Franklin Templeton.

Short-term:

- Fluctuations are possible amid macroeconomic news and regulation updates.

- Investment inflows via ETFs and institutional products will remain a key factor.

Long-term:

- The partnership with Franklin Templeton demonstrates the strategic interest of traditional finance in digital assets.

- BNB could become a key tool for tokenized products, accelerating the institutionalization of the crypto market.

💡 Conclusion: The combination of positive macroeconomics and strategic partnerships of major players creates a solid foundation for further BNB growth. Investors and traders are closely monitoring developments as digital assets increasingly integrate with traditional financial mechanisms, opening a new era of institutional participation in the crypto market.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.