🪙 The Bitcoin Standard: Will Cryptocurrency Replace Gold and Who Actually Came Up With It?

The Ghost of Gold: From Bit Gold to Bitcoin

In the late 1990s, cryptographer Nick Szabo created the Bit gold project — a decentralized currency with a fixed supply, similar to gold. The idea was never launched, but the image of “digital gold” took hold in the minds of crypto enthusiasts for a long time.

Szabo brought to the industry not only technology but also the “ghost of gold” — a metaphor that still lingers in the minds of investors and journalists.

How the Digital Gold Myth Was Born

Satoshi Nakamoto did not write about gold in the whitepaper. Bitcoin was designed as a peer-to-peer electronic currency. The only mention of precious metal relates to Proof-of-Work.

Fragment mentioning gold. Source.

However, the metaphor stuck. In 2011, Charlie Lee called Litecoin the “silver” to Bitcoin’s “gold.” In 2015, New York Times journalist Nathaniel Popper published Digital Gold, cementing the term.

Investors then joined in: the Winklevoss twins, BlackRock executives, etc. For example, in September 2020, Michael Saylor, CEO of Strategy, called Bitcoin “digital gold” and included it as the main corporate reserve asset.

After Donald Trump’s victory in 2024, the idea reached the White House.

Eric Trump speaks at Consensus 2025.

Precious Metal Simulation and the S2F Model

Why is the analogy convenient? Bitcoin has “gold-like” properties:

- limited supply (21 million coins);

- costly mining (energy and computations instead of pickaxe and shovel);

- gradual emission reduction (halving instead of resource depletion);

- divisibility (satoshis instead of bars).

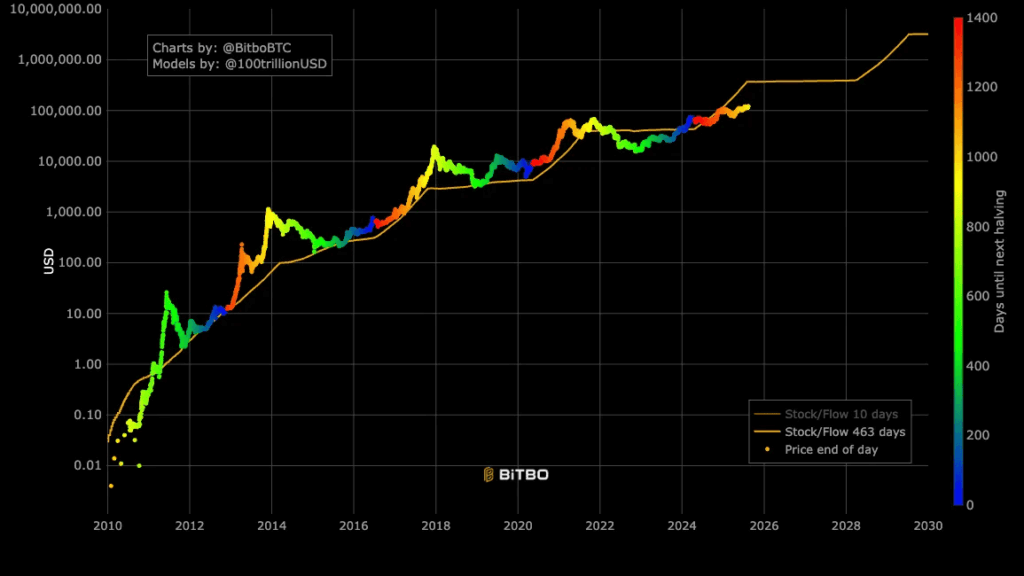

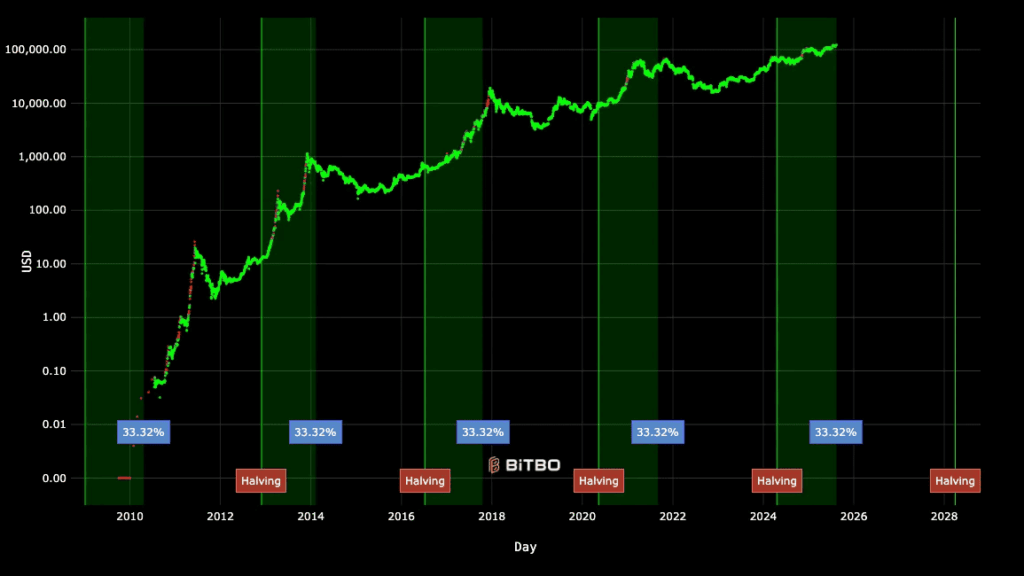

Analyst PlanB proposed the Stock-to-Flow (S2F) model in 2019, borrowed from the gold market. It showed impressive correlation with Bitcoin’s price, although critics argue the forecasts are overly idealized.

Bitcoin price relative to the S2F curve. Data: Bitbo.

Bitcoin price dynamics around halvings. Data: Bitbo.

Gold vs Bitcoin: Who Plays Which Role

In practice, it’s more complicated:

- Bitcoin’s returns are more correlated with stock indices than gold;

- During crises, gold stabilizes capital, while Bitcoin tends to follow stocks;

- Cryptocurrency moves in a “four-year halving rhythm,” whereas gold reacts to inflation, interest rates, and geopolitics.

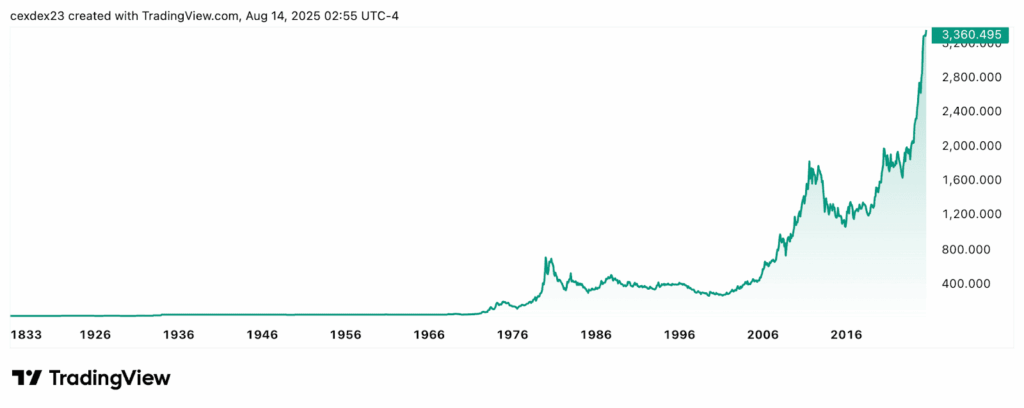

Gold has no built-in “mechanism” that regularly triggers price growth or decline. Its value is influenced by crises, inflation spikes, and geopolitical instability. In calm periods, gold can remain in a sideways trend for years or gradually lose value, then surge sharply, as in 2008 and 2022.

Gold price dynamics. Data: TradingView.

Is a Paradigm Shift Possible?

Bitcoin’s volatility has decreased in recent years, largely due to institutional capital and ETF inflows. The US is already discussing a strategic crypto reserve.

If governments start including Bitcoin in a “Gold Reserve 2.0,” the paradigm could indeed shift.

One difference between the two metals and Bitcoin is that gold and silver exist both physically and digitally, whereas Bitcoin exists only digitally.

💰 Conclusion: Gold vs Bitcoin

Gold is the time-tested senior cashier of global value. Bitcoin is its digital trainee, still learning to preserve capital.

In the short term, the cryptocurrency behaves like a risky stock market asset. In the long term, it has the potential to become a true “reserve metal” of the digital age.

Key question: Do investors have enough faith and governments enough courage to bet on the “new gold bearer”?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.