🚀 US Indexes: New Highs and Mixed Sentiment (Review for 10.09.2025)

US stock markets continue to rise, showing remarkable resilience amid mixed macro data.

- Nasdaq +0.4% — a new all-time high. September is already up +2%, unusual for a traditionally weak month.

- S&P 500 +0.3% — confidently holding above all moving averages, boosting technical optimism.

- Dow Jones +0.4% — only the third record close this year.

- Russell 2000 –0.6% — small caps continue to lag, reflecting pressure from high rates and weak demand.

Key Drivers

The main factor was the revised Bureau of Labor Statistics (BLS) employment data: it turned out the US economy created nearly 1 million fewer jobs than previously estimated. On average — 73k per month instead of 149k. This confirmed a weakening labor market and strengthened expectations for a Fed rate cut.

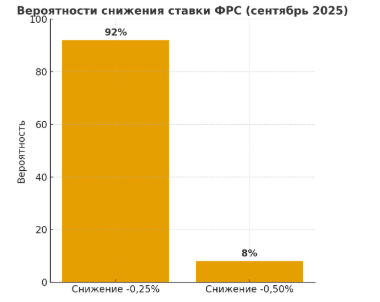

Probability of –0.25% cut: 92% of traders

- Probability of –0.50% cut: 8%

Bonds

The 10-year UST yield rose to 4.09%, but remains at the lower end of the 2025 range. The market is clearly pricing in future Fed easing.

Inflation — the Main Focus of the Week Today,

PPI (Producer Price Index) data is released; tomorrow — CPI (Consumer Price Index). These will determine the market’s next moves and Fed actions.

Scenarios:

- High Inflation (above PPI/CPI forecasts)

- Fed may limit the rate cut to –0.25%.

- Bond yields could spike above 4.2–4.3%.

- Tech and high-risk assets come under pressure.

- Defensive sectors attract interest: healthcare, utilities, commodities.

- Inflation in Line with Forecasts

- Base scenario: –0.25% rate cut.

- Markets continue gradual growth, maintaining optimism.

- Tech and growth companies (AI, semiconductors) remain in focus.

- Banking sector faces partial pressure due to expectations of cheaper money.

- Low Inflation (below forecasts)

Stocks & Sectors

- Oracle (ORCL) +20% after-hours — strong AI guidance.

- Palantir (PLTR) +4% — bounce from 50-day, technical entry signal.

- Taiwan Semiconductor (TSM) +1.5% — break of $248.28, strong report.

- CVR Energy (CVI) +7.5% — supported by crack spread increase.

- Apple (AAPL) –1.5% — market indifferent to iPhone 17.

Sector Leaders: communications, utilities, banks, refiners.

Laggards: construction, retail discounters, homebuilders.

📌Conclusion

The market remains resilient and sets new records, but the next 48 hours will be decisive.

All Fed decisions now depend on inflation data. Strong numbers — market cools, rate cut –0.25%. Weak numbers — chance for a more aggressive cut and a strong rally in risk assets.

Investor Strategy:

- Hold leaders (ORCL, PLTR, TSM)

- Add positions based on technical signals

- Use stops, considering volatility ahead of CPI release

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.