🔮 The past week (September 1–5, 2025) proved to be extremely eventful and tense for participants in global financial markets. Stock indices attempted to reach new all-time highs, but weak U.S. labor market data had a cooling effect, prompting caution among investors. The overall picture was mixed: some segments showed strong growth, while others faced profit-taking and volatility.

Key Events and Economic Background

U.S. Economy

The main pressure came from the August jobs report. Job creation fell short of analysts’ expectations, signaling a slowdown in economic growth. For investors, this has a dual meaning: on the one hand, weaker data raises concerns about future consumer demand; on the other hand, lower employment figures could push the Federal Reserve toward monetary easing at its upcoming September 17 meeting. A potential rate cut, according to market participants, could serve as an additional driver for equities.

Technology Sector

Apple

Apple’s stock extended gains, breaking a key resistance level. Investors are positioning ahead of the iPhone 17 launch on Tuesday, which is expected to set the tone for the tech sector in the weeks ahead and indirectly influence suppliers and accessory makers.

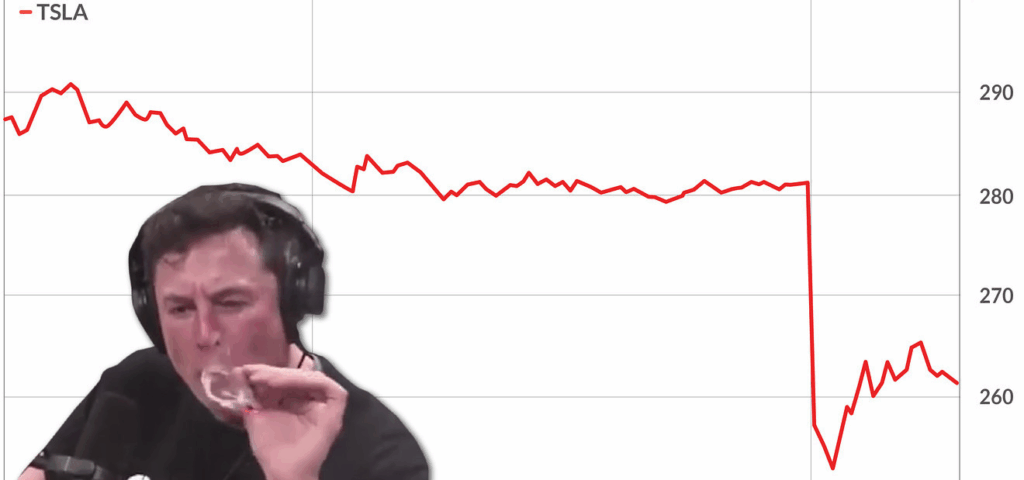

Tesla

Tesla shares surged, supported by two catalysts: news of robotaxi development and the unveiling of Elon Musk’s record bonus package.

These boosted investor interest and lifted the stock to key technical support levels.

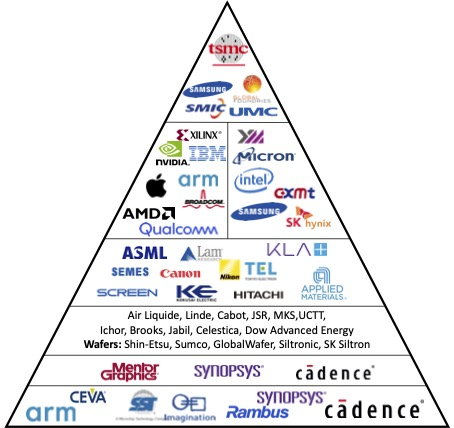

Semiconductors

Mixed performance: Micron and TSMC strengthened on strong demand for memory and AI chips, while Broadcom impressed with quarterly earnings.

Nvidia and AMD lost some momentum as investors took profits after recent rapid rallies, underscoring the sector’s sensitivity to AI-related demand expectations.

Other Sectors

Construction & Real Estate: positive momentum driven by falling mortgage rates.

Banks & Energy: weaker performance due to higher funding costs for banks and oil price volatility impacting energy firms.

Index Performance

- Nasdaq outperformed, led by tech giants.

- S&P 500 showed moderate gains.

- Dow Jones ended negative, dragged by industrials and energy.

- Russell 2000 hit new record highs, reflecting investor appetite for smaller-cap companies.

Next Week’s Focus

Apple’s iPhone 17 launch.

Inflation reports (PPI & CPI).

Earnings from Oracle, Adobe, and Rubrik.

🔥 Investor Takeaways

The market sits at record highs, but gains are unevenly distributed. Leaders like Apple, Tesla, and Micron continue to drive indices higher, while Nvidia and AMD face declines as profits are locked in.

The current environment favors selectivity: investors should focus on companies with strong fundamentals and institutional support rather than broad, indiscriminate exposure.

Overall, markets remain highly sensitive to macro data and corporate developments, making a selective, fundamentals-driven strategy the key to success.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.