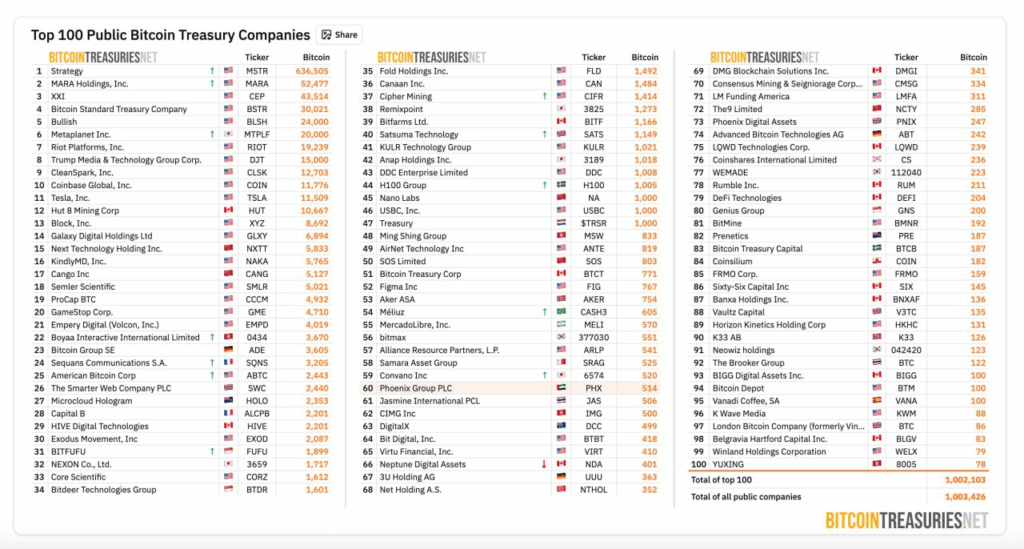

💼 Who Controls Almost 5% of BTC Supply?

According to BitcoinTreasuries.net, the 100 largest public companies in the world collectively hold 1,002,103 BTC, worth around $111 billion at the current price. That’s nearly 5% of Bitcoin’s total supply (remember, the maximum issuance is capped at 21 million coins).

This makes corporations one of the key forces in the crypto market, comparable to sovereign wealth funds or the largest ETFs.

Why does it matter?

- Asset concentration. When such volumes of Bitcoin are controlled by a limited number of companies, it affects liquidity and market volatility. Even relatively small movements of these coins can trigger significant market reactions.

- Institutionalization of Bitcoin. While once considered primarily a tool for retail investors and enthusiasts, Bitcoin is now actively used by major corporations – from tech giants to financial institutions.

- Signal of trust. For the market and retail investors, this serves as a clear signal: if the largest companies trust Bitcoin enough to hold it on their balance sheets, it increasingly looks like “digital gold” and a long-term store of value.

Biggest Bitcoin holders among companies

ChatGPT сказал: Although the list includes a hundred participants, several players clearly stand out.

1. MicroStrategy

- Balance: over 226,000 BTC (around $25 billion).

- Led by Michael Saylor, the company has become Bitcoin’s leading corporate evangelist. For MicroStrategy, it’s not just an investment, but a core strategy: “Bitcoin as the primary store of value.”

2. Marathon Digital Holdings (MARA)

- One of the largest Bitcoin miners in the U.S.

- Owns tens of thousands of BTC, both mined and purchased on the market.

- Seen as a leader in adopting transparent mining practices.

3. Tesla

- In 2021, Elon Musk’s company purchased ~43,000 BTC, sparking massive hype.

- Some holdings were later sold, but Tesla remains one of the top corporate holders.

4. Coinbase Global Inc.

- The U.S. crypto exchange holds BTC both for operational needs and long-term strategic purposes.

5. Block Inc. (бывш. Square)

Jack Dorsey’s company actively invests in Bitcoin and integrates it into its payment services.- Dorsey is known as one of Bitcoin’s strongest advocates among tech entrepreneurs.

Geography of corporate Bitcoin

Interestingly, most of the top holders are concentrated in the U.S. This is explained by:

- a high degree of regulatory acceptance of crypto activity,

- availability of institutional instruments (ETFs, public companies, funds),

- support from venture and public capital markets.

In Europe and Asia, corporate Bitcoin holdings are rarer, largely due to stricter regulations.

Risks and challenges

- Regulatory pressure. Growing corporate interest in BTC inevitably attracts regulators. The U.S. and EU are already preparing additional crypto reporting requirements.

- Market dependence on “whales.” If even a few major holders decide to sell large volumes, it could trigger a cascading price drop.

- Corporate strategies. Not all companies use Bitcoin the same way. For some it’s a long-term reserve, for others a speculative tool. Accordingly, the market impact varies.

What does it mean for investors?

- Positive:

- Major companies have effectively “legitimized” Bitcoin, making it part of the global financial system.

- Institutional purchases reduce the risk of crypto being fully marginalized.

- Major companies have effectively “legitimized” Bitcoin, making it part of the global financial system.

- Negative:

- Concentration in the hands of a limited number of players makes Bitcoin less “decentralized” than theory suggests.

- The influence of individual CEOs (like Elon Musk or Michael Saylor) on BTC’s price has become enormous.

- Concentration in the hands of a limited number of players makes Bitcoin less “decentralized” than theory suggests.

📉 Bottom line

The world’s 100 largest public companies collectively hold 1,002,103 BTC ($111 billion) – nearly one in every twenty coins ever issued.

This clearly shows how far Bitcoin has come from its “garage” origins and how serious a player it has become in the global economy.

Whether corporate Bitcoin becomes the foundation of a new financial order or a source of future bubbles remains to be seen. But one thing is certain: business can no longer ignore the first cryptocurrency.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.