🚀 What Altseason Is and Why It Matters

Altseason is a period in the cryptocurrency market when altcoins outperform Bitcoin. According to the classical “capital flow theory,” it all starts with BTC:

- Bitcoin rises, generating profits for investors.

- Part of the profit is realized and capital flows into altcoins.

- Alts grow because their market cap is smaller, so new investments have a stronger impact on price.

The result — sharp price jumps, especially in low-cap coins, where gains of hundreds of percent are no longer extraordinary.

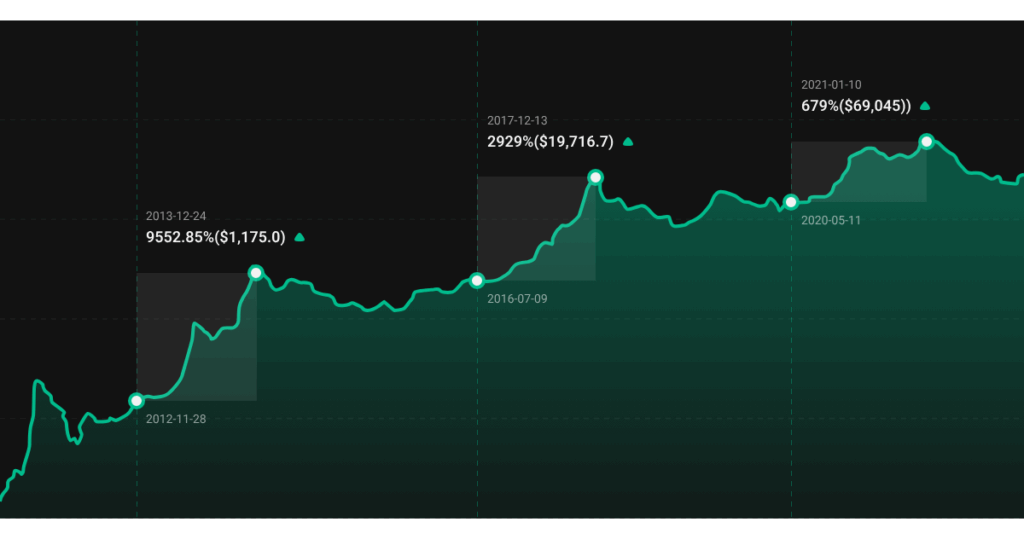

The surge following Bitcoin’s previous halving. Source: kucoin.com

Historical context

2017 — the first notable altseason during the ICO boom. Investors rushed into everything, and many tokens showed X50–X100 returns.

- 2021 — the second major cycle. DeFi and institutional adoption were in focus. Bitcoin corrected by −10–20%, and dozens of altcoins “went to the moon.”

Since then, the altseason has become the “holy grail” for traders: everyone awaits it like summer during school years — and it feels like it’s just about to arrive.

The first alternative coins appeared just two years after Bitcoin’s launch. Namecoin (2011) was the first altcoin in the industry and is still traded, although its significance has waned. This shows that the altcoin sector has been dynamic and ever-changing from the start.

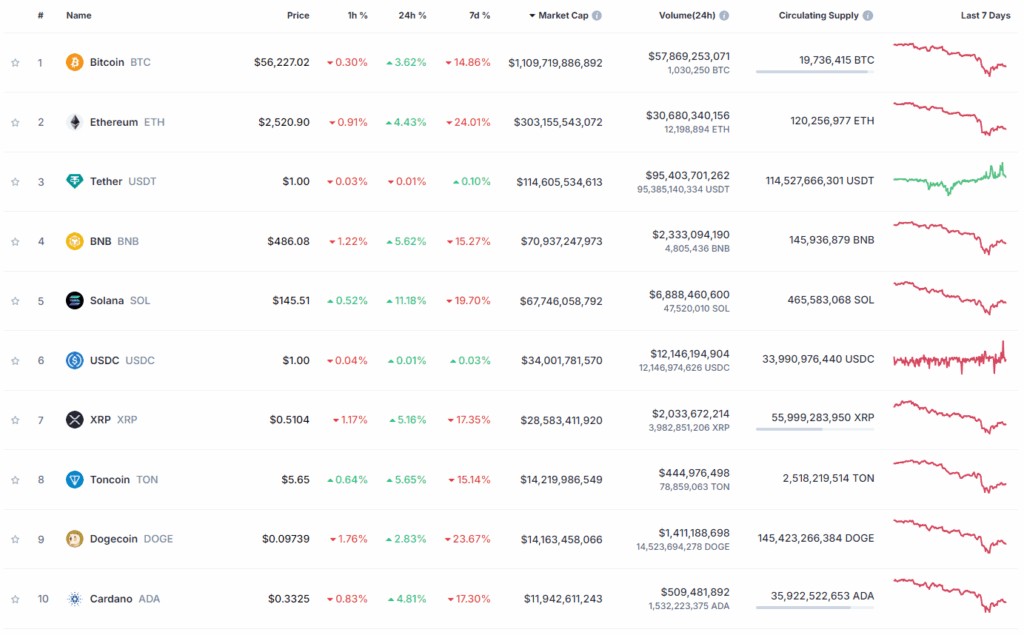

At different stages, the leaders were and remain Ethereum (ETH), Solana (SOL), Toncoin (TON), Dogecoin (DOGE), and others.

Top 10 cryptocurrencies by market capitalization. Data: CoinMarketCap.

2025: signals and doubts

- Bitcoin under pressure. Since February, BTC has often traded below $100,000. Prices are pressured by news that the US Department of Justice got permission to sell 69,370 BTC seized during the Silk Road era. A massive $6.5B sale could trigger a correction.

- BTC dominance is falling. In the first half of the year, it reached 56%, dropping to 52–53% by autumn — usually a signal that capital begins flowing into alts.

- Interest in new sectors is rising. AI tokens, GameFi, and DePIN projects are in focus. Their rallies resemble early stages of previous altseasons.

Reasons for altseason emergence

- Capital rotation: after BTC growth, investors seek higher returns and move into the “second tier.”

- Low altcoin capitalization: even modest inflows can trigger a “parabola.”

- New trends: AI, metaverses, DeFi 2.0, meme coins — catalysts for massive growth.

- Herd effect: the more success neighbors have, the more new players flock to alts.

Example of an altseason index. Data: Blockchaincenter.

Market impact

- Volatility spike: alts can jump +30% or drop −20% in a single day.

- Leadership shifts: while BTC sets the tone, altcoins create new success stories.

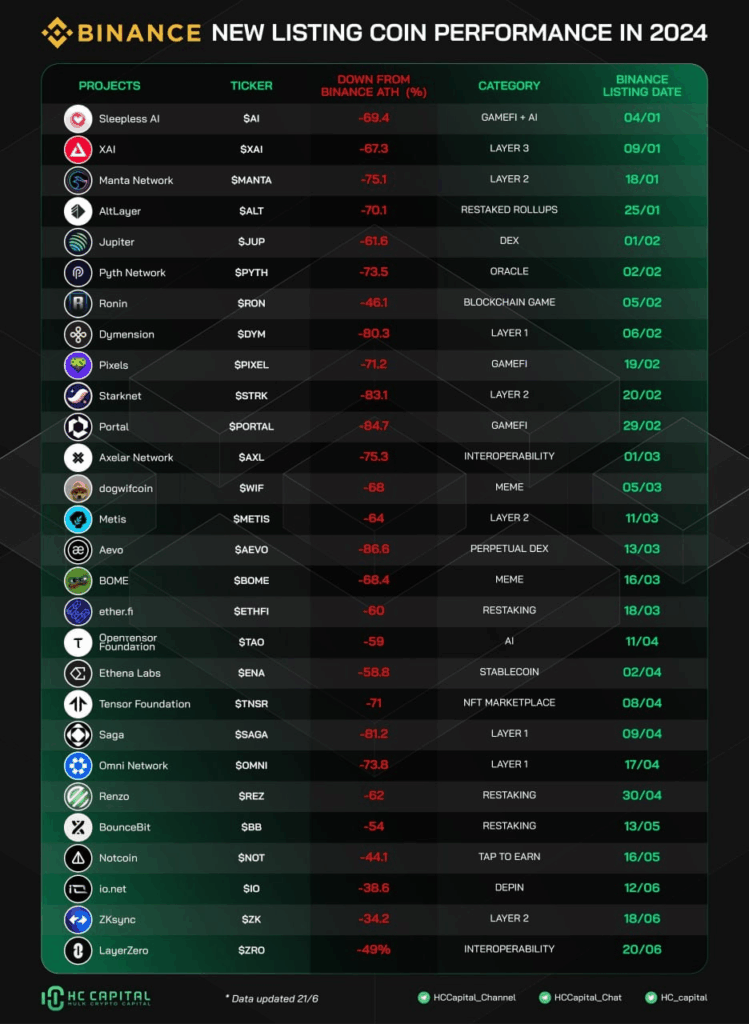

- Bubble risk: when capital flow slows, alts are the first to fall sharply.

Should we expect an altseason by the end of 2025?

The situation looks ambiguous:

- On one hand, signals are evident: BTC dominance falling, second-tier revival, hype around new trends.

- On the other hand, pressure factors — DOJ BTC sell-off and general market slowdown after record highs.

The likelihood of a “partial altseason” by the end of 2025 is high: certain segments (AI tokens, DePIN, meme coins) may see explosive growth, but a full parabolic cycle across the entire alt market is premature.

Profitability of altcoins that started trading on Binance in 2024. Data: HC Capital.

💡 Conclusion:

Altseason remains a cyclical phenomenon, appearing when the market is ready for risk. In 2025, conditions are gradually forming, but the ultimate “blast-off” depends on BTC dynamics and external factors.

Investors should remember: altseason is always a celebration — but with a costly hangover. The “enter on time — exit on time” strategy is more relevant than ever.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.