🔍 Analyst Joao Wedson, founder and head of the analytical platform Alphractal, made a bold statement that drew the crypto community’s attention to October 2025. According to him, Bitcoin has just one month left before the end of the current four-year cycle, but the conclusion of this period could be extremely volatile and unexpected.

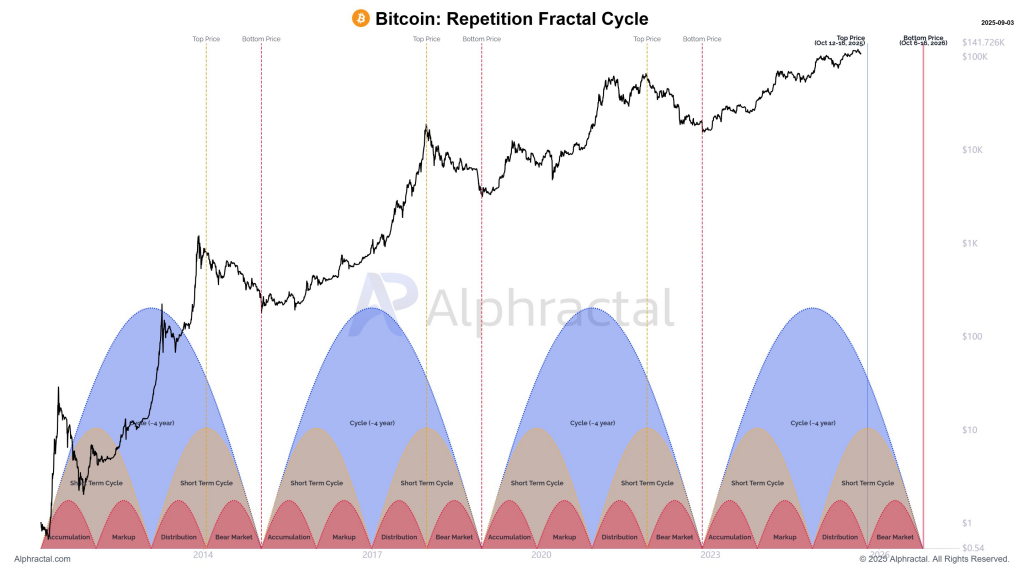

Four-Year Bitcoin Cycles. Source: Joao Wedson

What Are Four-Year Bitcoin Cycles?

Four-year Bitcoin cycles are historically observed patterns related to halvings (reduction of miner rewards) and BTC price dynamics. Typically, a cycle includes a period of rapid growth, followed by a correction and preparation for the next bull rally. In recent years, this pattern has closely reflected market fluctuations: after each halving, Bitcoin’s price surged sharply and then corrected.

Four-Year Bitcoin Cycles. Source: Joao Wedson

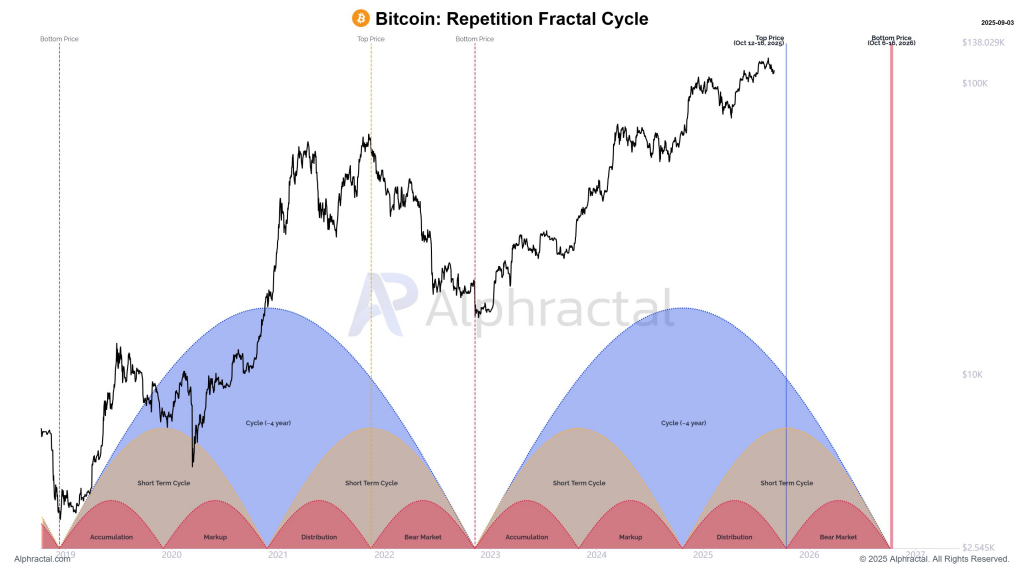

Joao Wedson suggested back in 2024 that October 2025 could mark the completion of the current cycle. If his forecast proves correct, it would mean the current bull market is reaching its logical conclusion.

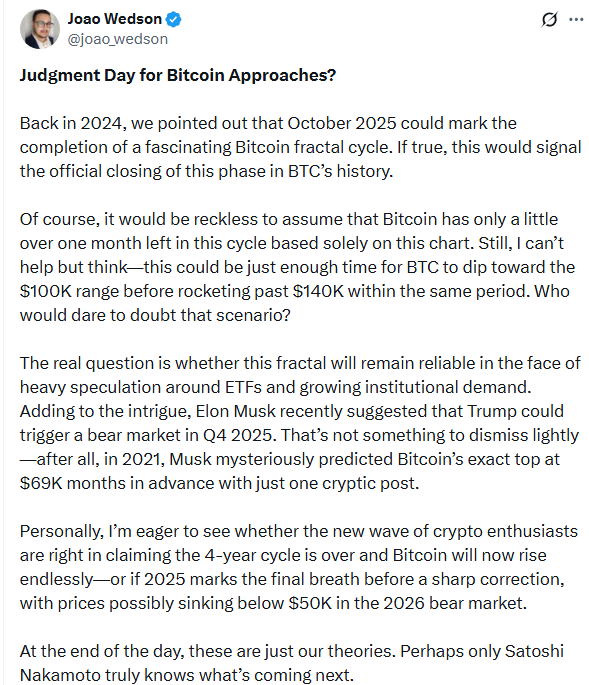

Joao Wedson noted on X: “Looking back to 2024, we pointed out that October 2025 could mark the completion of a fascinating Bitcoin fractal cycle. If true, this would signal the official closing of this phase in BTC’s history.

Of course, it would be reckless to claim that Bitcoin has only a little over one month left in this cycle based solely on this chart. Still, I can’t help but think—this could be just enough time for BTC to first dip toward the $100,000 range and then surge above $140,000 within the same period. Who would dare to doubt that scenario?”

Short-Term Scenario: Rise Before the Fall

Wedson emphasizes that drawing final conclusions solely based on charts would be too risky. However, he presents an intriguing short-term scenario: in the remaining time, Bitcoin could first rise to $100,000 and then continue climbing above $140,000 before the expected bear market begins.

This scenario implies that investors and traders could still realize significant profits, but the long-term outlook appears less optimistic. If the four-year cycle holds, a drop to $50,000 in 2026 becomes a realistic scenario for a bear market.

Features of This Cycle

Wedson notes that the current cycle is radically different from previous ones. The market is influenced by large institutional investors, and Bitcoin is gradually becoming a full-fledged financial asset. Active speculation around ETFs, growing institutional demand, and macroeconomic factors can significantly impact price dynamics.

“The question is whether the fractal will remain a reliable forecasting tool when new factors emerge, such as institutional demand and active speculation,” the analyst notes.

Influence of Public Figures

An interesting layer of intrigue comes from statements by well-known entrepreneurs. Wedson mentions that Elon Musk allegedly hinted that political figures like Donald Trump could trigger a bear market in Q4 2025. In the past, for example, in 2021, Musk predicted Bitcoin’s exact peak at $69,000 months in advance, although these claims were not officially confirmed.

🚀 End of an Era or a New Beginning?

The analyst admits that forecasts are not exact science, reminds that these are only hypotheses, and openly shares his thoughts: “Personally, I am eager to see whether the expectations of the new wave of crypto enthusiasts, claiming that the four-year cycle is over and Bitcoin will now rise endlessly, will prove correct—or whether 2025 will mark the final breath before a sharp correction, with prices possibly falling below $50,000 in the 2026 bear market.”

He adds wryly that perhaps only Bitcoin’s creator, Satoshi Nakamoto, truly knows the plans. October will show whether Bitcoin can maintain its bullish momentum or if the four-year cycle will prevail, setting the tone for the next stage of the crypto market.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.