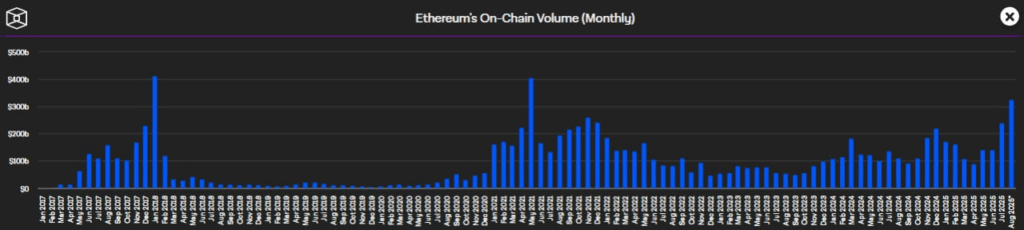

📈 Ethereum network transaction volume exceeds $320 billion — highest since 2021 and a challenge to Bitcoin

In August 2025, the Ethereum blockchain posted one of its most impressive monthly results ever: transaction volume exceeded $320 billion. This is the third-largest monthly volume in the network’s history and the highest since May 2021.

Ethereum network transaction volume. Data: The Block.

Growth Factors

According to The Block, over the past 30 days the network recorded:

- a record number of unique transactions;

- second-highest number of active addresses in network history;

- TVL (Total Value Locked) remaining near historical highs.

Analysts also note several additional drivers:

- Lower fees. The average transaction cost on Ethereum has dropped to multi-year lows, stimulating network activity.

- Institutional demand. Corporate treasuries continue to accumulate ETH, and the volume of spot ETH ETFs is steadily increasing.

- DeFi and staking growth. Market participants report sustained interest in smart contract ecosystems and passive income protocols.

Analysts’ opinion

Standard Chartered experts emphasize that Ethereum remains an undervalued asset. According to their assessment, the growth drivers include:

- expansion of corporate adoption of the coin;

- sustained interest in ETFs;

- gradual strengthening of Ethereum’s position relative to Bitcoin.

CryptoQuant analysts previously noted that ETH may turn out to be more attractive to institutional investors than BTC. The reason is simple: Ethereum has real-world utility — from DeFi to NFTs and corporate solutions.

Ethereum vs. Bitcoin

While Bitcoin is traditionally seen as “digital gold,” Ethereum is increasingly referred to as “digital infrastructure.” The growing transaction volume confirms that a significant part of the modern blockchain economy is being built on Ethereum.

Price and Outlook

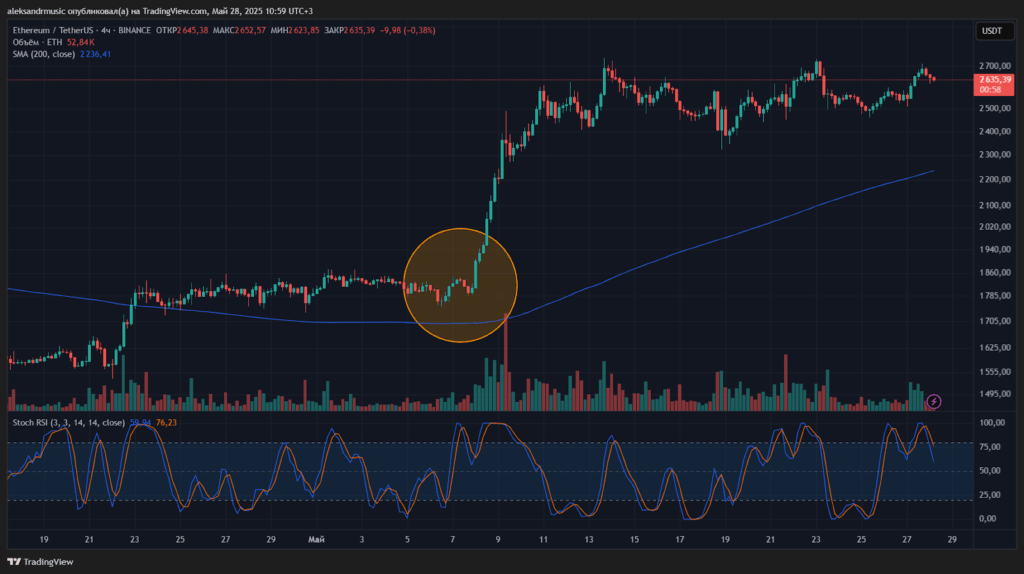

ETH/USDT chart on Binance. Source: TradingView.

At the time of writing, ETH is trading around $4,400 (Binance, TradingView data). However, experts believe that its growth potential is far from exhausted. A combination of institutional demand, low fees, and record network activity could push the price to new all-time highs in the coming months.

📌Conclusion

Ethereum has once again proven that it remains a key player in the crypto market. Its strength lies in combining investment appeal with real-world utility. If August trends persist, Ethereum could establish itself not only as an alternative to Bitcoin but also as the core technological platform of the digital economy.

Ethereum is also currently in the “zone of interest” for institutional investors: on-chain metrics, TVL, and ETF inflows provide a solid fundamental basis for growth. However, the difference between “growth potential” and “growth guarantee” is huge: scenarios ranging from $7.5k to $15k and beyond are possible but come with corresponding risks. Approach investments with a plan and risk management — and remember, the market always has a backup scenario.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.