🚀 Former Binance CEO Changpeng Zhao (CZ) made a bold statement: he believes that Bitcoin will become a global reserve currency in the future, serving as “digital gold” and the foundation of the global financial system. According to Zhao, the unique features of the first cryptocurrency — a capped supply of 21 million coins, decentralized architecture, and protection against inflation — will inevitably lead governments, corporations, and investors to increasingly use BTC as a universal store of value and payment tool.

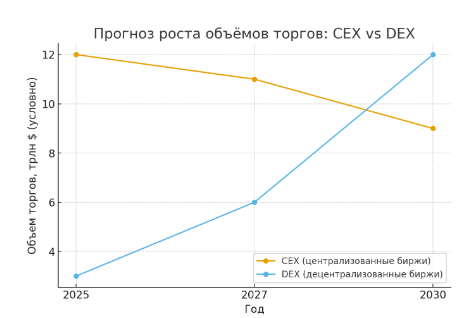

CZ also noted that the cryptocurrency market structure will undergo significant changes: in a few years, trading volumes on decentralized exchanges (DEX) could surpass those on centralized platforms (CEX). In his view, transparency, absence of intermediaries, and increased user trust in decentralized solutions will be the key factors driving this transition.

Regarding the industry’s future, Zhao highlighted several areas where he expects a new “explosion” of innovation:

- Integration of blockchain with artificial intelligence (AI). Combining these technologies could radically change approaches to data processing, automation, and security.

- Growth of tokenized real-world assets (RWA) — from real estate and stocks to commodities and artworks. This will make investments more accessible and liquid for millions of people.

- Development of stablecoins as a main bridge between the traditional financial system and digital assets, ensuring stable payments and global adoption of cryptocurrencies in everyday economics.

Current trading volumes on centralized exchanges (CEX) still dominate, but CZ expects the balance to shift toward DEX in the future.

Historical context: from gold to the dollar — and next to Bitcoin?

CZ’s statements echo the history of the global economy. In the 20th century, reserve currency status first belonged to gold and then shifted to the US dollar. After World War II, the dollar became the foundation of the Bretton Woods system and later strengthened its role in global trade and finance.

According to Zhao, Bitcoin could follow a similar path — from an “alternative asset for enthusiasts” to a universal tool for payments, savings, and international reserves. Its limited supply and independence from central banks create conditions for this transition, especially amid inflation risks and growing distrust of fiat currencies.

Chart forecast: DEX could surpass CEX by 2030.

👍 Thus, Changpeng Zhao’s statement should not be seen as the fantasy of an enthusiast but as a strategic vision based on long-term trends.

- The world has already experienced reserve currency shifts: from gold to the British pound, then to the US dollar.

- Today, against the backdrop of global inflation, geopolitical instability, and accelerated digitalization, demand is growing for assets independent of central banks and governments.

- Bitcoin, with its limited supply, high liquidity, and increasing institutional adoption, becomes a candidate for a universal “digital reserve.”

The scenario CZ describes does not imply an immediate abandonment of the dollar but a gradual transition to a multipolar financial system, where Bitcoin could occupy the position that gold has held for thousands of years — a symbol of global value and trust.

A clip of Changpeng’s speech can be viewed on our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.