📉 We’ve been waiting, and finally it happened: on Friday, markets reacted strongly to the speech of Federal Reserve Chair Jerome Powell at the Jackson Hole symposium. The main news – the U.S. central bank may start cutting interest rates earlier than expected.

Powell emphasized that U.S. inflation is showing signs of slowing, and current policy is already exerting the necessary pressure on prices. He noted that the Fed is ready to adjust its actions based on economic data, rather than strictly following the previous schedule for rate hikes. Markets interpreted this as a “green light” for further stock growth. By acknowledging that inflation remains slightly above the target, Powell called the price increases caused by tariffs a temporary phenomenon, instilling optimism among market participants.

Hourly chart BTC/USD as of August 22, 2025

How markets reacted

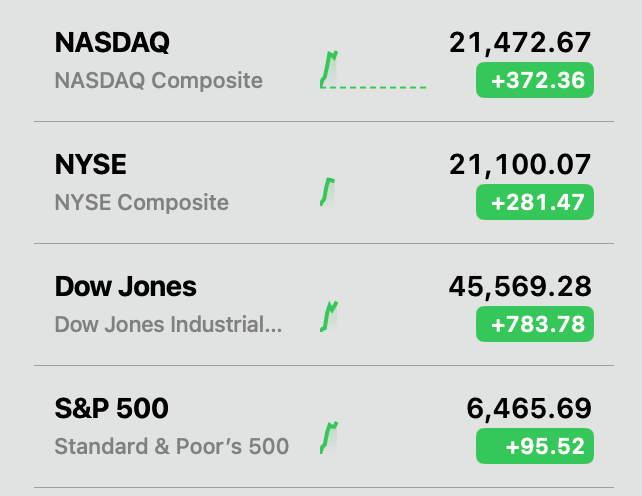

After Powell’s words, indices rose almost simultaneously: Dow Jones reached historic highs, S&P 500 approached records, and Nasdaq rebounded after recent declines. Small-cap stocks and the technology sector showed the greatest dynamics, indicating these segments’ heightened sensitivity to rate signals.

The reaction was immediate: traders began closing short positions and increasing long positions, expecting cheaper borrowing in the future and corporate profit growth as financial burdens decrease.

Stock markets on August 22, 2025, after Jerome Powell’s speech.

What traders should keep in mind

- The PCE inflation data, due next week, will be a key indicator for the Fed. If inflation continues to decline, rates are likely to move lower and the rally could extend. However, if price growth accelerates, the market may face a sharp correction.

- Technical levels of stocks remain important: rebounds after a strong Fed speech are a signal for caution, not for unconditional buying.

- Reaction to corporate reports. The technology sector is particularly sensitive, where the results of Nvidia and other leaders may strengthen or weaken the effect of the Fed’s speech.

Key takeaways for traders:

- a signal for cautious stock buying, especially in sectors sensitive to rates and credit;

- volatility will remain – even a positive Fed speech does not guarantee smooth growth;

- monitoring inflation (PCE) is the main indicator that will confirm or refute market expectations;

- reports from market leaders (like Nvidia) can amplify movement or trigger a correction.

Quotes from Jerome Powell:

“Four and a half years after the emergence of COVID-19, the worst economic distortions associated with the pandemic are gradually fading.”

“Our goal has been to restore price stability while maintaining a strong labor market and avoiding a sharp rise in unemployment.”

“Inflation has brought significant hardships, especially for those least able to cope with the rising cost of essential goods.”

“It is unlikely that the labor market will become a source of elevated inflationary pressure in the near term.”

“The direction is clear, while the timing and pace of rate cuts will depend on incoming data, evolving outlook, and the balance of risks.”

“Disinflation while preserving labor market strength is only possible with well-anchored inflation expectations, which reflect public confidence that the central bank will over time achieve 2% inflation.”

“The limits of our knowledge, so evident during the pandemic, call for humility and a spirit of inquiry focused on learning from the past and applying those lessons flexibly to today’s challenges.”

🔍 Summary

Powell’s speech demonstrated the Fed’s readiness to adapt monetary policy to the real economy rather than follow a rigid schedule. For traders, this means high volatility: stocks and indices may rise, but any unexpected macroeconomic news can sharply shift market sentiment.

The key rule is to closely monitor inflation and corporate reports, avoid jumping into trades without technical confirmation, and use Fed signals as guidance rather than direct instructions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.