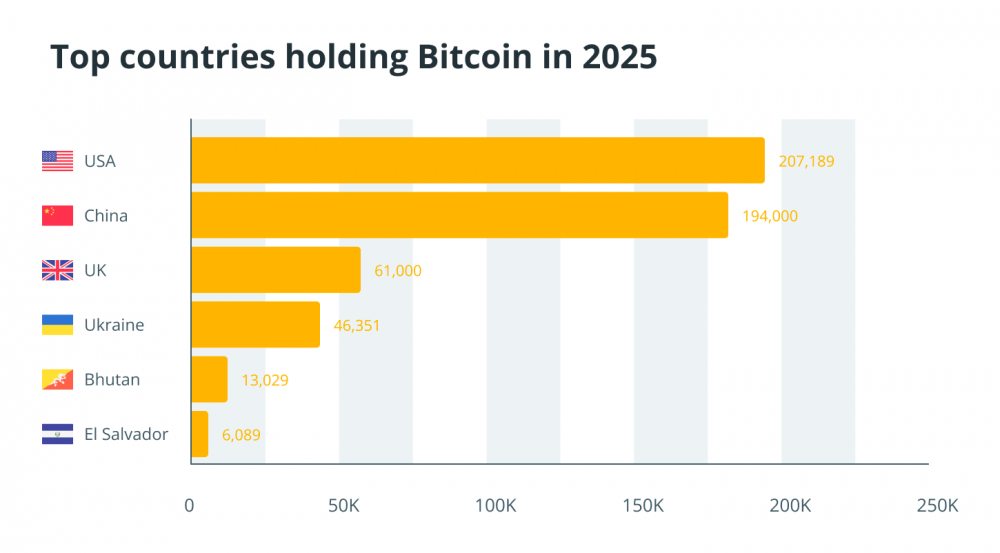

💰 According to blockchain data and public legal disclosures, about 463,000 BTC, or roughly 2.3% of the total bitcoin supply, are currently owned by governments worldwide. Two countries dominate this list, and their positions are no secret.

United States

The U.S. government is the most prominent player in bitcoin ownership. According to Bitbo, it holds 207,189 BTC (about $25.16 billion). Most of this reserve was acquired through cryptocurrency confiscations from criminals and a series of high-profile arrests — from Silk Road to darknet operations and ransomware shutdowns.

In March 2025, President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve, consolidating all confiscated bitcoins under federal control. This signals that bitcoin is now seen not just as a seized asset but also as a strategic tool of U.S. foreign policy.

China

China ranks second. In 2019, authorities confiscated over 190,000 BTC in the PlusToken case — one of the largest seizures in crypto history. Some of these assets may have been liquidated, while others are likely stored in cold wallets. Despite the domestic ban on trading and mining, China remains a key player in the geopolitics of bitcoin.

Bhutan

Bhutan quietly builds one of the largest national bitcoin reserves. Since 2019, Druk Holding & Investments has been using hydropower facilities for mining. By 2025, 12,000–13,000 BTC (~$1.1–1.3 billion) are expected to be mined, representing 30–40% of the country’s GDP.

- Eco-friendly: 100% renewable energy

- Economically efficient: electricity converted into crypto assets

- Centralized management: government strategy

United Kingdom

In 2021, about 61,000 BTC were confiscated during a money laundering investigation. The assets are under police and Crown Prosecution Service control. No official decision has been made to include these bitcoins in the strategic reserve, but the UK is already among the top government holders.

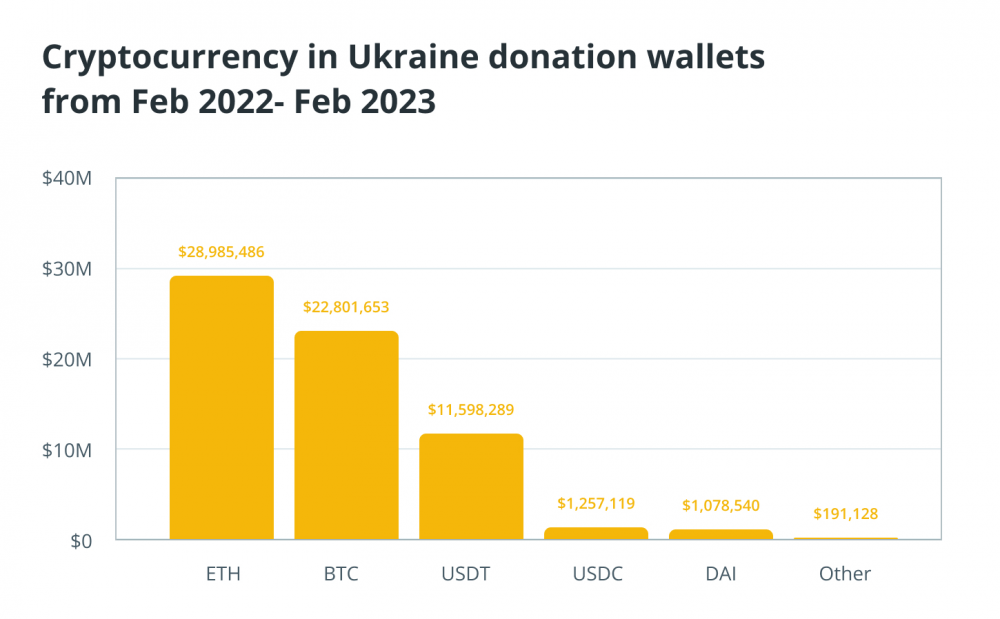

Ukraine

Ukraine used bitcoin as a fundraising tool during the military conflict. Over $70 million in BTC was received in the first year of the conflict, and by mid-2025, state reserves amounted to only 186 BTC, indicating rapid spending of crypto assets.

El Salvador

El Salvador became the first country to recognize bitcoin as legal tender. By January 2025, the government had accumulated over 6,000 BTC. Even after revoking bitcoin’s legal tender status, it remains a key element of the national strategy.

Iran

Since 2019, Iran has legally mined bitcoin and sold it to the Central Bank. This allows the country to circumvent sanctions and accumulate crypto assets. Iran’s share of the global hash rate was 4–7%, with most mining going to the state.

New Players

- UAE: rumored up to 420,000 BTC

- Bulgaria: over 200,000 BTC confiscated in 2017 (unverified)

- Other countries: Finland (~90 BTC), Georgia (~66 BTC), Venezuela (~240 BTC)

🕵️ Why Quiet Bitcoin Accumulation Matters

Some governments openly announce their intentions to invest in bitcoin or use it strategically. Others act quietly: mining crypto, managing assets indirectly, or accumulating via state funds without disclosing scale. Motives vary — from economic diversification to sanctions circumvention — but the pattern is clear: hidden bitcoin accumulation by countries is shaping a new layer of global financial policy.

For some countries, this is a form of strategic diversification. Bitcoin functions as digital gold — a scarce, limited resource independent of central bank policies. This is particularly important for nations seeking to protect their reserves from inflation, reduce reliance on the dollar, and strengthen financial stability.

Strategic examples:

- Bhutan converts hydropower surplus into sovereign capital through mining, strengthening its economy without debt.

- Iran legalizes and controls mining to circumvent sanctions and finance imports.

- U.S. consolidated confiscated bitcoins in the federal Strategic Bitcoin Reserve.

Quiet accumulation carries risks: bitcoin volatility remains high , transparency is low, and geopolitical pressure may force governments to adjust or hide strategies.

Secrecy, on the other hand, allows governments to accumulate assets without speculative pressure or the risks of sudden market impact. This enables them to systematically build financial reserves and use bitcoin as a long-term strategic tool rather than merely a speculative asset.

⚡ Conclusion: Whether public or hidden, these countries are creating a new level of global economic strategy. Bitcoin is no longer just a private investment tool — it is becoming a state asset and a strategic policy instrument, capable of influencing financial independence, international relations, and long-term economic stability

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.