💻 Nvidia Under Pressure: China Closes Market for H20

What happened:

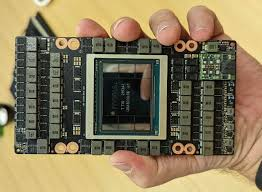

Nvidia has paused the release of its AI chip H20, developed specifically for the Chinese market. Chinese authorities have explicitly advised companies to refrain from purchasing these chips, citing security concerns. H20 was designed to bypass U.S. export restrictions, but now the market is effectively closed for the new product.

Why it matters:

China is one of Nvidia’s largest markets, so the suspension of sales could slow the company’s growth. NVDA shares, as well as competitors like AMD and TSMC, have come under pressure. The situation clearly illustrates how geopolitics and trade restrictions can sharply alter the prospects of tech companies and affect the semiconductor market.

Risks for traders:

- Trading NVDA and similar stocks is currently high-risk.

- Until Nvidia’s earnings report on August 27, the market may remain nervous and volatile.

- Any attempts at long or short positions may face sharp price swings, so careful risk management is essential.

⚠️ Conclusion:

Monitor updates, manage risks, and act cautiously. The Chinese market for H20 is temporarily closed, and the impact on Nvidia’s quarterly results is yet to be assessed. The situation underscores the importance of tracking geopolitical factors when investing in the tech sector.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.