💹

One of the first questions beginner traders ask is: how much can you really earn on Forex? It’s a logical question: everyone wants to understand what their time and effort will bring, and how the results compare to other earning opportunities. Some expect over 100% annual return, while others are skeptical even about 30%.

So, how much can you actually earn on Forex?

Key facts

- The average Forex trader’s income depends on experience, capital, strategy, and market conditions.

Beginners earn $100–500 per month.

Professionals — $5,000–10,000+ per month. - Beginners often face losses in the first months; stable profit requires learning and practice.

- Experienced traders with proper risk management can achieve up to 200% monthly returns using leverage, but it comes with high risk.

- Leverage increases potential profit but also the chance of a stop-out.

- Limiting risk to 2% per trade reduces the chance of large losses.

- Income depends on trade frequency, take-profits, and asset volatility; average daily pair volatility is 80–100 points.

- Copying successful traders’ trades allows beginners to earn without deep knowledge and increases efficiency.

Average Forex trader earnings

Income varies greatly depending on experience, strategy, capital, and market conditions. Beginners earn less as stable profit takes time and practice. Experienced traders with proven strategies and risk management are more likely to have steady earnings.

Trading approach matters: some make many small trades, others fewer but larger trades. Therefore, the answer to “how much can you earn” is always individual.

Beginner trader

Income is limited: the trader is learning basic skills. According to 2024 statistics, beginners can earn $100–500 per month with cautious trading and small capital. Many may not earn stable profit initially or may incur losses.

Professional traders

Experienced traders with efficient risk management earn significantly more. Average income can be $5,000–10,000+ per month depending on strategy, capital, and market conditions. In the UK, traders earn up to £155,634 per year (~£12,970 per month), with performance bonuses increasing income.

Independent traders

Traders working on their own capital may earn from a few hundred to a few thousand dollars per month. Successful traders earn $2,000–5,000, but the lack of fixed income makes earnings unstable.

How earnings work on Forex

Forex is a market where currencies are bought and sold. Income depends on:

- Starting capital (more funds → higher profit).

- Leverage (allows controlling larger positions).

- Liquidity and volatility of the currency (more active market → more trades).

Practical example 1: $2,000 deposit without leverage

- Minimum trade size — 0.01 lot (1,000 units).

- 1 pip value for EUR/USD = $0.10.

- Average daily movement = 80–100 pips → $10/day.

- Monthly potential (20 trading days) = $200 (10% of deposit).

Drawbacks: spreads, swaps, risk management, and potential losses.

Practical example 2: $2,000 deposit with 1:1000 leverage

- Risk per trade = 2% ($40).

- Total trade size = $40,000.

- 1 pip value = $2.

- Daily profit for 100 pips = $200/day.

- Monthly potential = $4,000 (200%).

Remember: this is revenue; net profit is lower due to spreads, swaps, and previous losses. Without risk management, leverage can cause a stop-out.

Tips for beginners

- Start small, aim for stable 3–5% monthly profit.

- Track your trades (e.g., via MyFxBook).

- Trade with a proven strategy; you can copy experienced traders’ trades (social trading).

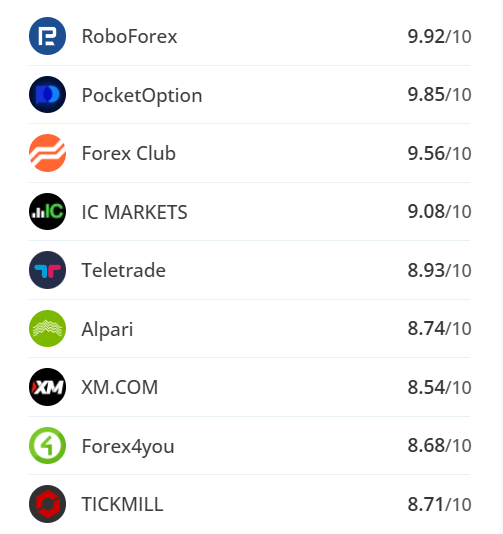

Top Forex Brokers

📌 Conclusion

Income depends on:

- Deposit size

- Leverage used

- Strategy and trade frequency

- Asset volatility

- Experience, patience, and willingness to learn

How much can you earn in 3 months? It depends entirely on you: your risk tolerance and time commitment.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.