📰 Analysts at Presto Research have called Bitcoin’s record surge an «inflation illusion».

Experts believe that BTC’s rise reflects not so much the cryptocurrency’s real strength as the devaluation of the dollar.

This publication was made on the X network.

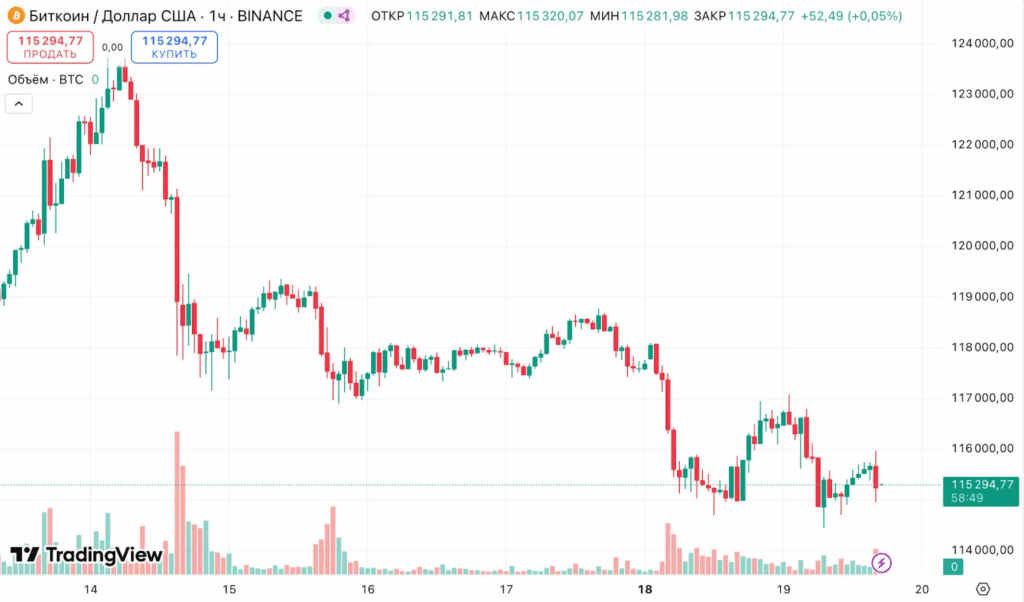

On August 14, Bitcoin hit a historic high of $124,000, but soon corrected to $115,292.

Hourly BTC/USD chart on Binance. Source: TradingView

“A ruler with floating markings”

Analysts compare the situation to measuring length with a ruler whose markings constantly change. By increasing the money supply, central banks make any nominal fiat value incomplete.

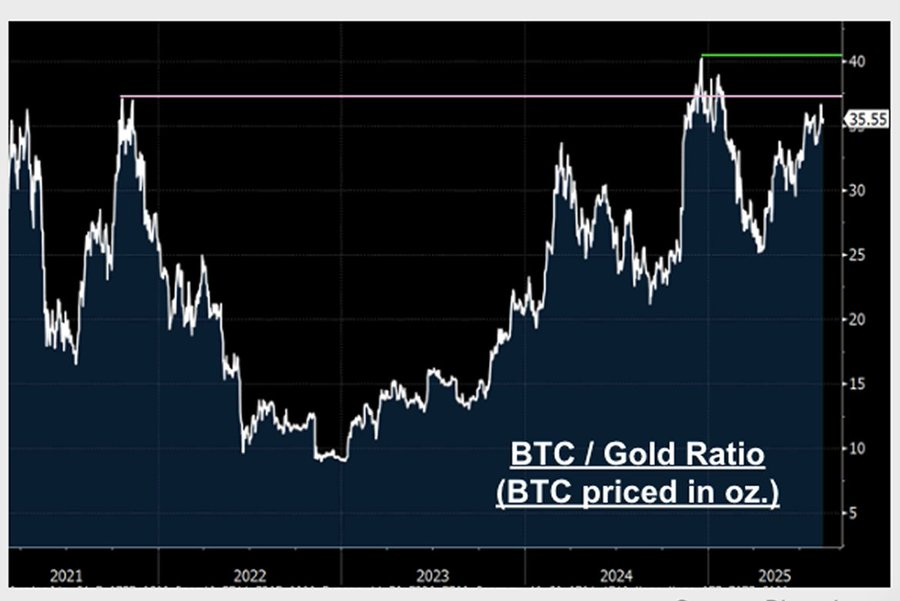

Therefore, analysts suggest measuring Bitcoin in gold — an asset with limited supply and independent status. This approach shows that despite strong growth in recent years, Bitcoin in terms of gold remains below the 2021 peaks and post-2024 election levels.

Inflation or adoption?

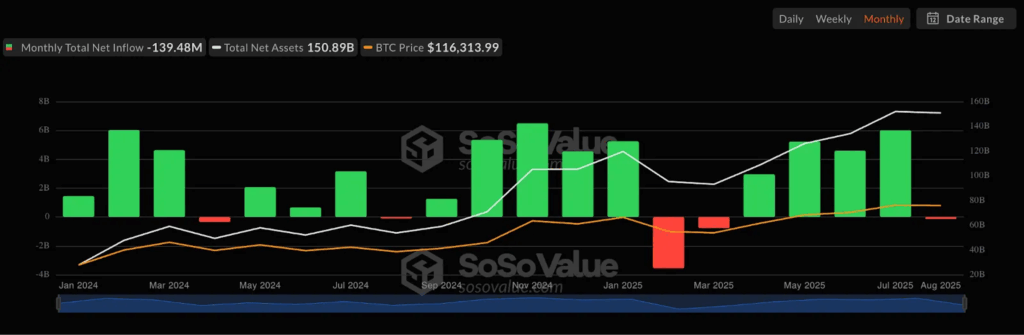

Presto believes current BTC dynamics are more linked to inflation expectations than widespread adoption as a payment method. However, thanks to inflows into Bitcoin ETFs and corporate purchases, the asset appears «undervalued».

Monthly inflow and outflow chart for spot Bitcoin ETFs (positive balance is maintained, confirming institutional interest). Source: SoSoValue

Analysts note that increasing institutional interest, the emergence of new products on regulated exchanges, and the inflow of retail investors may, in the long term, offset the «illusion» effect.

Parallels with U.S. gold reserves

These conclusions align with current debates in Washington over U.S. gold reserves. The Treasury still values 260 million ounces of gold at the 1973 price of $42.22/oz ($10.9 billion), while its market value is close to $750 billion.

Thus, just as gold is undervalued in Treasury accounts, Bitcoin in dollars may reflect not growth, but a decline in the currency’s purchasing power.

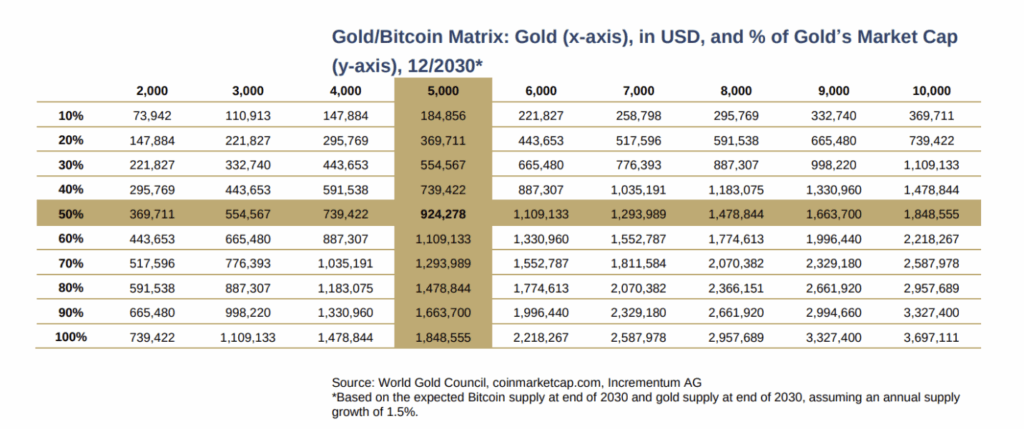

Gold/Bitcoin matrix. Source: In Gold We Trust

Bitcoin’s link to gold remains key for assessing its future. Forecasts indicate potential growth to six-figure levels by 2026 and approaching $1 million by 2030.

By the way, we prepared a brief analysis of the precious metals market here.

💡 Conclusion:

Bitcoin’s record dollar price may not be proof of its «victory», but rather an indicator of fiat weakness. For an objective assessment, one should consider not only the dollar but also gold or other limited-supply assets. Meanwhile, investment interest in BTC remains high, making it both an «inflation illusion» and a «revaluation opportunity».

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.