📅 August 19, 2025

Global background

A constructive meeting took place in Washington between Trump and Zelensky. Paths to peace and potential trilateral talks with Russia are being discussed. Amid optimism for peace, oil prices are slightly declining: Brent around $66, WTI — $62.

💡 Conclusion: hopes for resolving geopolitical risks are reducing economic concerns and putting pressure on the energy sector.

US indices and futures

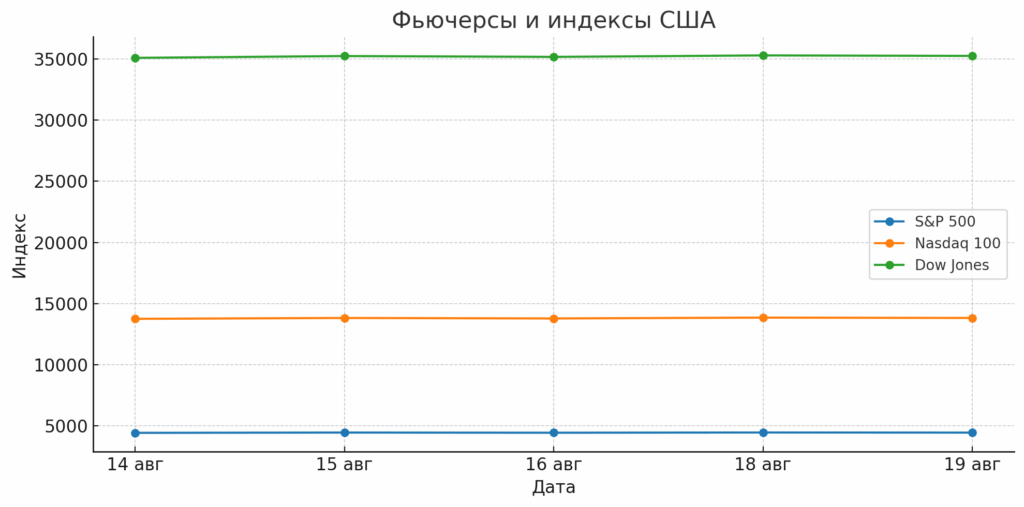

Yesterday, August 18:

- Dow Jones — slight decline Nasdaq — up S&P 500 — almost unchanged

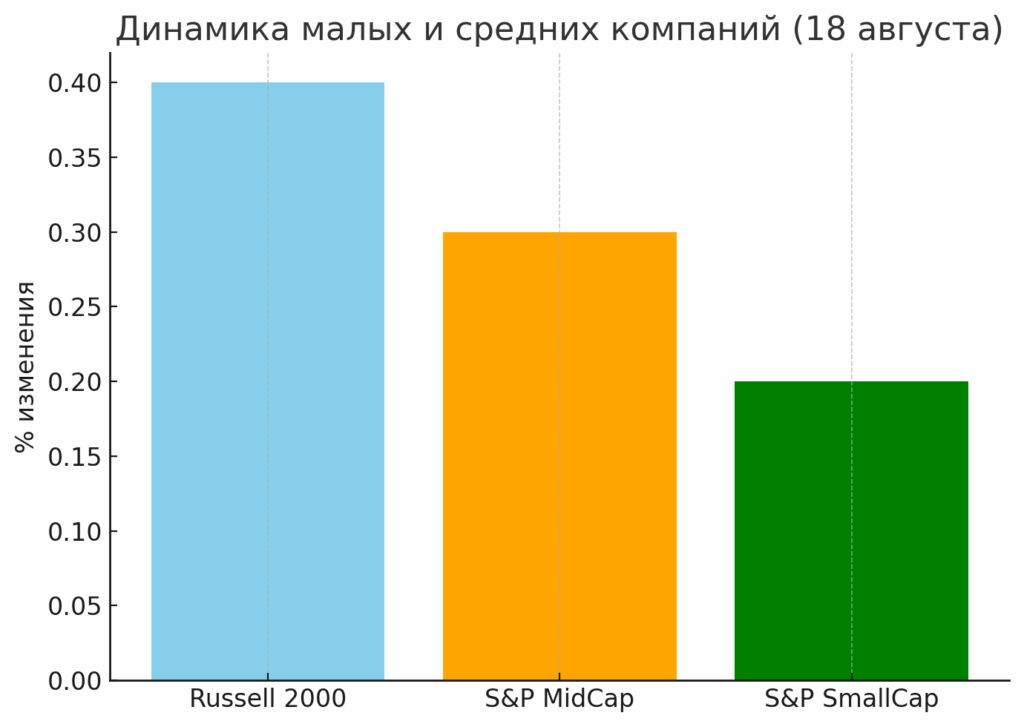

- Small and mid-cap companies show strength: Russell 2000 +0,4%, S&P MidCap +0,3%, S&P SmallCap +0,2%

Today, August 19 (pre-market): S&P 500 -0,2%, Nasdaq 100 -0,2%, Dow -0,1%

Main driver: investors are waiting for the Jackson Hole symposium and Powell’s speech. The probability of a rate cut in September is estimated at almost 83%.

Retail

- Home Depot is preparing to report revenue growth, with a significant improvement expected compared to last year.

- Attention is also on Lowe’s, Target, and Walmart.

💡 Conclusion: retailer reports provide a clear picture of the US consumer — demand remains solid.

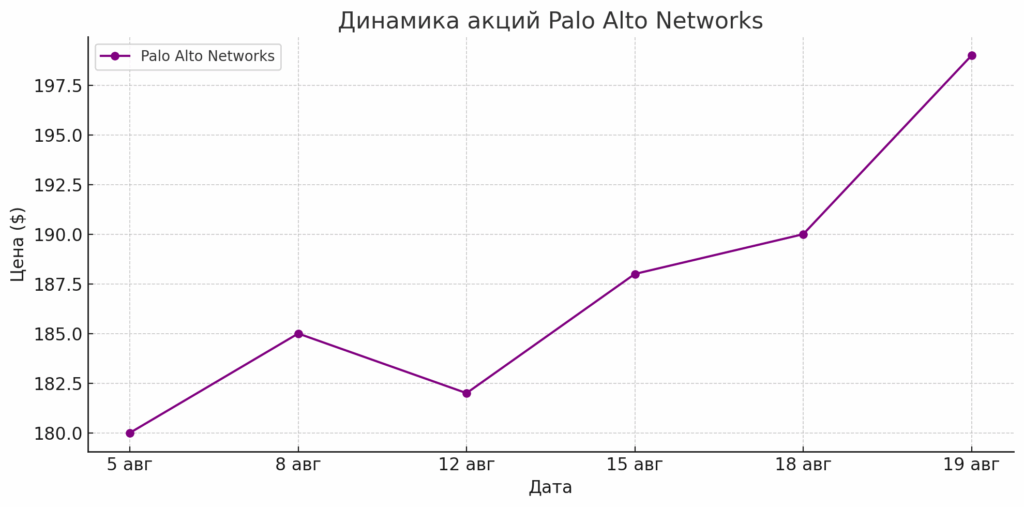

Cybersecurity and technology

- Palo Alto Networks impresses: 2026 forecast exceeds expectations.

- Key drivers: AI and cloud cybersecurity solutions.

- Pre-market: +5%

Verdict: an attractive long for those seeking tech stocks with growth potential.

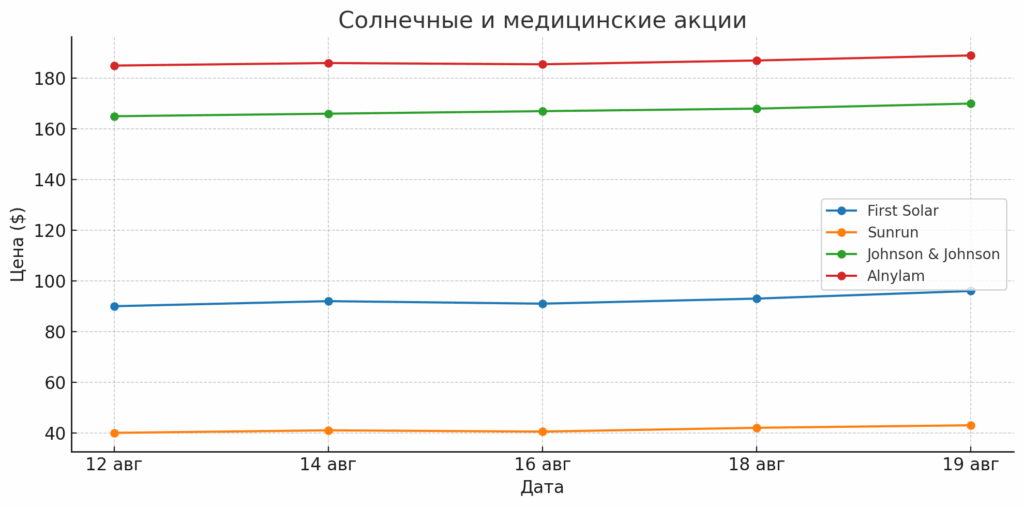

Solar and healthcare stocks

- Solar: First Solar, Sunrun, Nextracker — rising after subsidy announcements

- Healthcare: Johnson & Johnson, Alnylam, BeOne — new highs

💡 Conclusion: government support and steady demand create growth opportunities in these sectors.

Summary and key observations

- Small and mid-cap companies continue to show strength.

- Promising sectors for growth: AI, cybersecurity, solar energy.

- Retail and Fed decisions remain the main drivers for the coming days.

- Futures dipped slightly today, but the market remains steady, signaling a solid base for further growth.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.