📈 US Futures and Indexes

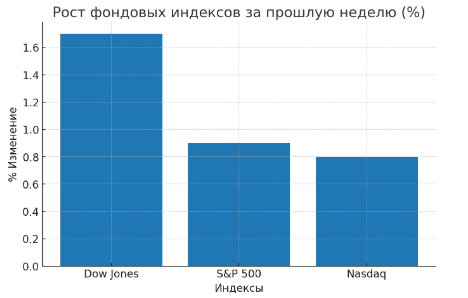

American futures and indexes opened slightly lower ahead of key events this week. Despite the pause in growth, the market remains near all-time highs: Dow Jones rose +1.7% last week, S&P 500 +0.9%, Nasdaq +0.8%, while the Russell 2000 small-cap index posted its best performance in the past six months, gaining +3.1%.

Federal Reserve

The main event remains Jerome Powell’s speech in Jackson Hole on Friday. Market participants estimate an 85% probability of a rate cut in September, although recent inflation and retail sales data have slightly cooled optimism. Minutes from the July Fed meeting showed that some officials were already leaning toward a rate cut due to weakness in the labor market.

Geopolitics

On the geopolitical front, attention is focused on the meeting between Donald Trump and Volodymyr Zelensky in Washington. Kyiv insists on a “quick and reliable” end to the conflict, demanding that Moscow withdraw its troops.

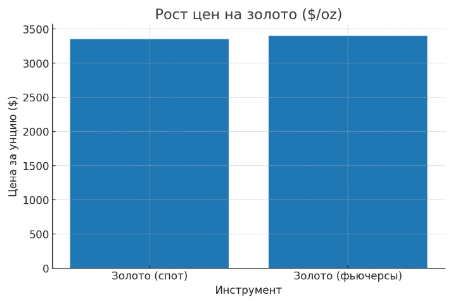

Rising uncertainty supports gold: quotes rose to $3,355 per ounce, and futures approached $3,400.

Stocks in focus:

- Tesla (buy point 367.71, current range 348–330)

- Micron (buy point 129.85, current 120–128)

- AppLovin (buy point 428–473)

- Palo Alto Networks (EPS $0.89, revenue $2.5B)

The tech and AI sector is undergoing a correction after weak reports from several companies, but some stocks continue to hold key levels and create entry points. Reports this week will also include Walmart, Home Depot, Lowe’s, TJX, and Amer Sports.

Other sectors and ETFs

Finance, construction, airlines, and biotech show strong dynamics. Notable ETFs: ARKK (+3%), ARKG (+8%), XHB (+4.8%), and JETS (+8.4%).

⚡Summary: The market remains bullish, but the coming days may bring higher volatility due to Fed decisions and geopolitical factors. Investors should keep strategies under control, update watchlists, and consider defensive assets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.