📌 The U.S. Treasury may begin official BTC purchases

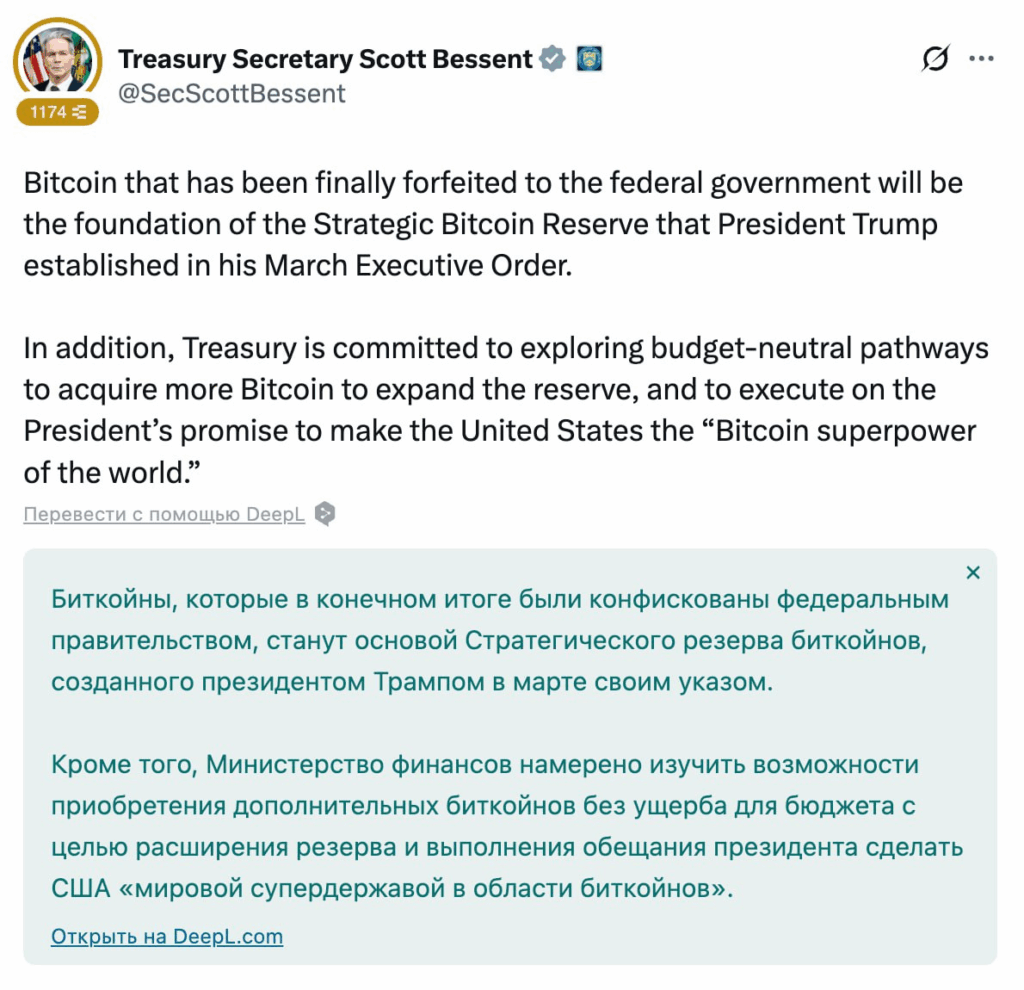

U.S. Treasury Secretary Scott Bessent made a statement that could reshape the entire architecture of global finance. According to him, the government is considering systematically accumulating Bitcoin in a national reserve.

A new strategic course

- Bessent said that the Treasury is exploring budget-neutral mechanisms for buying BTC.

- The foundation for the future reserve already exists — Bitcoins confiscated by federal authorities during investigations (for example, Silk Road cases or hacker attacks).

- These will serve as the basis for the Strategic Bitcoin Reserve, established by presidential decree from Donald Trump in March 2025.

A historic turnaround

Until now, U.S. authorities followed a different tactic: confiscated crypto assets were sold at auctions, which often pressured the market.

Now the approach is changing 180 degrees: instead of selling, the focus is on holding and accumulating.

For the first time, the world’s largest economy is ready to recognize Bitcoin not just as a “digital asset,” but as a strategic financial instrument.

Geopolitical aspect

This move is not only economic but also political.

- The U.S. aims to secure leadership in the cryptocurrency space.

- It also sends a signal to competitors: China, which is actively developing the digital yuan, and Europe, where the role of stablecoins and crypto regulation is being discussed.

- In the long term, the U.S. could use Bitcoin as a tool of geopolitical influence — from financial alliances to transactions with partners.

Possible market implications

- Increased trust: if the U.S. officially becomes a BTC holder, institutional players may accelerate entry into the crypto market.

- Supply shortage: some coins will be held in the strategic reserve, reducing circulation, which could push prices higher.

- Start of a race: other countries, fearing falling behind, may consider creating their own crypto reserves.

- Evolution of Bitcoin’s role: from an “alternative asset,” it becomes a tool of government finance and global policy.

Why now

- U.S. national debt exceeds $37 trillion — Washington needs new financial tools.

- Intensifying competition with China in technology drives proactive steps.

- President Trump has repeatedly stated his intention to turn the U.S. into a “Bitcoin superpower.”

⚡ Conclusion

If this plan is implemented, a new era will begin in the global economy: Bitcoin will move from being a “hobbyist currency” to a strategic state asset. For the crypto market, this could signal long-term growth.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.