? The market continues to hold within a bullish trend. Investors are increasingly paying attention not only to short-term price movements but also to where strong fundamentals are supporting growth. In September, several major players from different sectors are in focus.

Micron (MU)

Fundamentals: demand for HBM memory (High Bandwidth Memory), used in Nvidia graphics cards and AI server solutions, is growing rapidly. T

he entire production quota for 2026 is essentially already sold out before the year begins. HBM margins are roughly twice as high as standard DRAM, allowing the company to significantly increase profitability. Competition is a factor, as Samsung is actively investing in expanding capacity and may capture part of the market.

Technical: support around $119 (50-day SMA). Early entry possible at $122.77, key resistance at $128.60.

Idea: a strong candidate for a technology portfolio, especially amid the rapid growth of the AI segment.

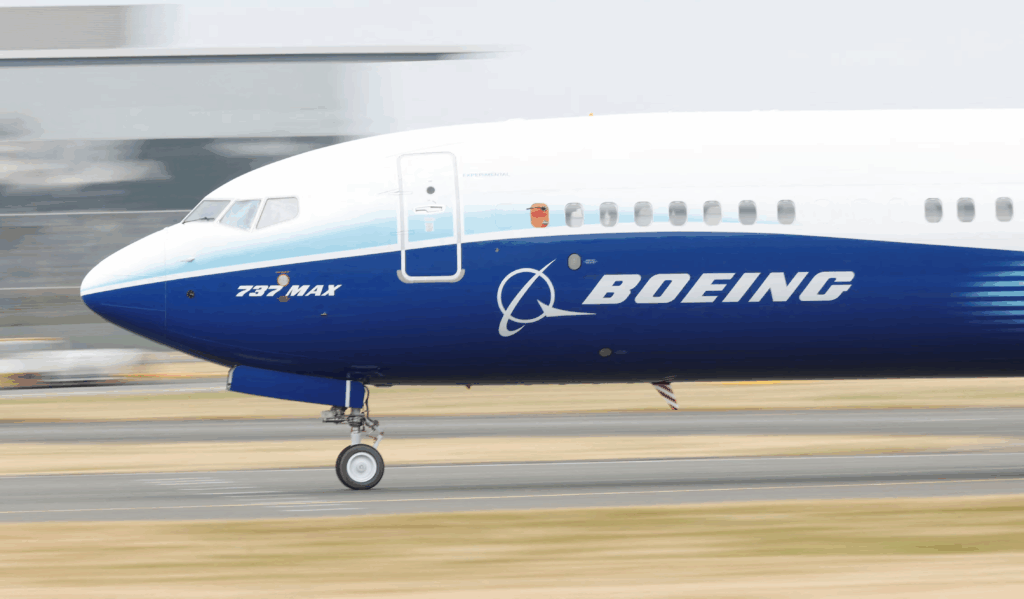

Boeing (BA)

Fundamentals: the company continues to gradually recover after a challenging period.

Large orders from Korean Air strengthen its position, along with expectations for a potential deal with China. Production of the 737 MAX is growing slowly but steadily. Confirmation of new contracts would provide an additional driver for shares.

Technical: early entry at $238.05, main resistance at $242.69. Support — 21-day exponential moving average.

Idea: if shares hold above key levels, Boeing can continue its upward movement. Attractive for medium-term investors given strong demand drivers.

Netflix (NFLX)

Fundamentals: the company maintains a stable subscriber base. New content, including «KPop Demon Hunters», shows impressive viewership.

Advertising revenue is gradually increasing. However, Netflix faces high competition in streaming and limited upside for stock price growth.

Technical: prices are currently below the 50-day SMA. The first entry signal is a breakout at $1,251.16; key resistance at $1,341.15.

Idea: do not rush to buy; the optimal strategy is to wait for confirmation of a trend reversal and consolidation above resistance.

Cadence Design Systems (CDNS)

Fundamentals: revenue grew over 20%, and management raised the full-year forecast.

Cadence is a key player in the EDA market (electronic design automation), essential for companies developing AI infrastructure and semiconductors.

Technical: early entry at $356.91, key resistance at $376.44.

Idea: suitable for long-term investors betting on sustainable AI-sector growth. Best to buy on a strong resistance breakout.

MercadoLibre (MELI)

Fundamentals: the leading e-commerce and fintech company in Latin America continues strong growth.

Online sales increased by 21%, fintech by 39%. EPS was below expectations, but growth in core areas offsets the shortfall.

Technical: shares have broken the downtrend and hold above the 50-day SMA, making them attractive for entry.

Idea: interesting for portfolio diversification outside the US and Europe. Latin America is becoming an increasingly promising market.

Comparison of investment ideas for September 2025

| Company | Fundamentals | Technical (key levels) | Risks / Comments | Investor Takeaway |

|---|---|---|---|---|

| Micron (MU) | High demand for HBM for Nvidia, margin twice as high as standard memory, 2026 already “sold out” | Support 119, early entry 122.77, target 128.60 | Competition with Samsung | Technology favorite, attractive for medium-term investment |

| Boeing (BA) | New orders from Korean Air, potential deal with China, 737 MAX | production growth Early entry 238.05, main resistance 242.69 | Reputational risks and regulation | Strong growth driver, but requires risk management |

| Netflix (NFLX) | Content success, stable subscriber base, advertising growing | Currently below 50-day SMA, signal only at 1,251.16 | Streaming competition, high costs | Wait for confirmation of reversal, do not rush |

| Cadence (CDNS) | Revenue growth +20%, raised forecast, products essential for AI | Entry at 356.91, resistance 376.44 | Dependent on AI infrastructure growth | Reliable long-term option, best entry on resistance breakout |

| MercadoLibre (MELI) | E-commerce +21%, fintech +39%, business growing faster than forecasts | Above 50-day SMA, broke downtrend | Competition in LatAm, currency risks | Good regional diversification |

? Conclusion:

- The strongest combination of fundamentals and technical factors is seen in Micron and Boeing.

- Cadence Design and MercadoLibre are interesting for long-term investment, particularly amid AI growth and emerging markets.

- Netflix should be monitored, but entering before trend confirmation is risky.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.