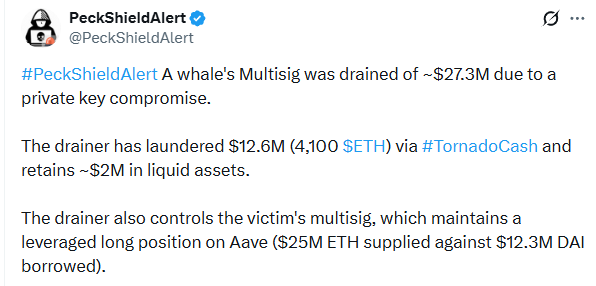

An unknown attacker managed to gain access to the private key of one of the owners of a multisignature wallet and withdraw crypto assets totaling about $27.3 million, according to analytics firm PeckShield. This incident once again draws attention to the risks associated with storing large amounts of cryptocurrency even when using more complex security mechanisms.

A multisignature wallet is a type of crypto wallet that requires the approval of multiple participants via corresponding private keys to execute transactions. Such a structure typically increases the level of security by reducing the likelihood of unauthorized access, however the compromise of even a single key makes all assets linked to the wallet vulnerable. In this case, it was precisely this vulnerability that was exploited by the attacker.

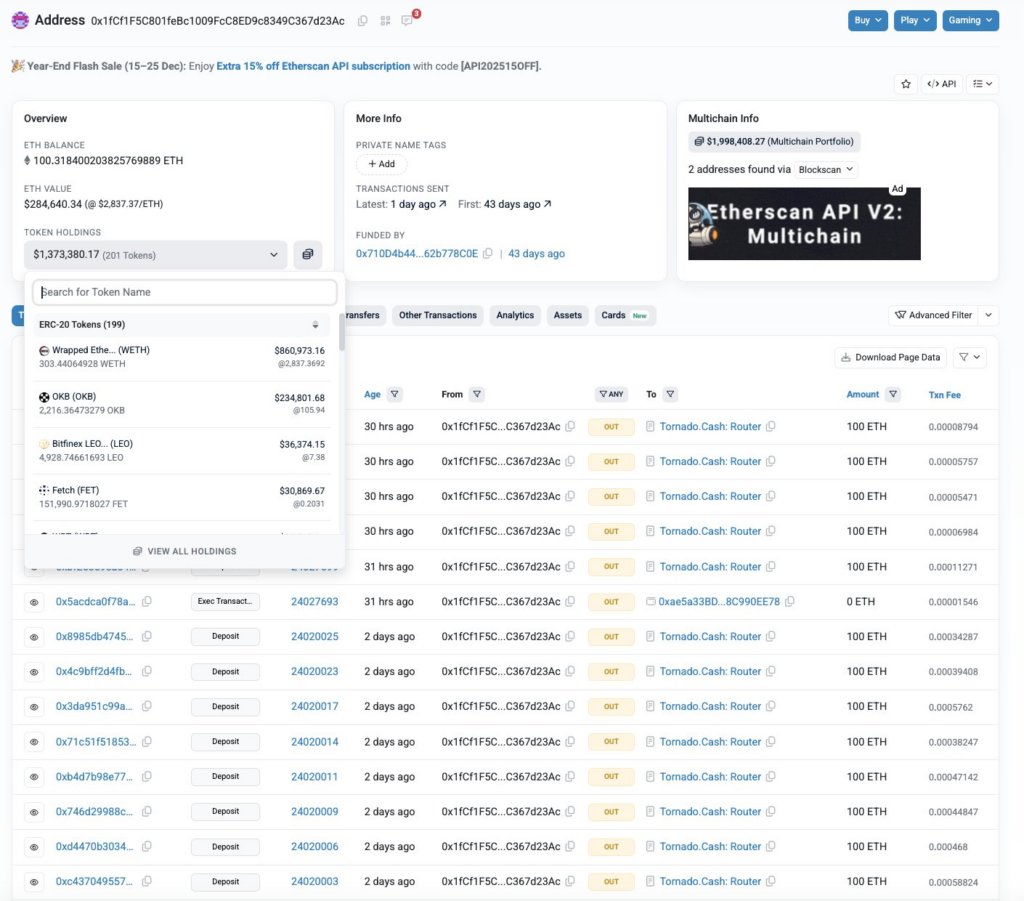

According to PeckShield, a significant portion of the stolen funds – approximately 4,100 ETH, which exceeds $12.6 million at the current rate – has already been laundered through the Tornado Cash mixer. At the time of publication, the hacker is holding around $2 million in liquid crypto assets that have not yet been moved.

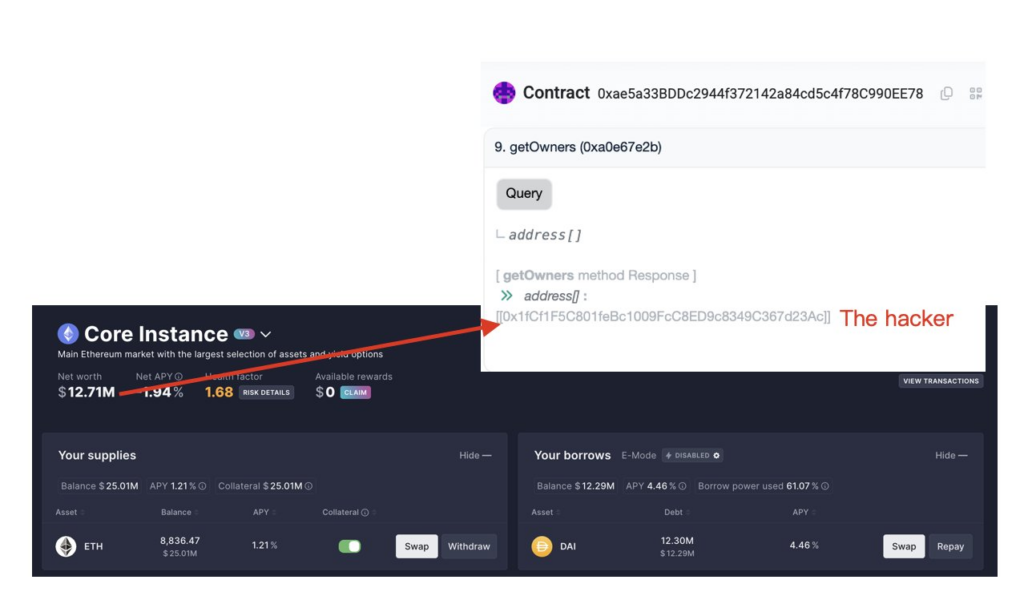

In addition, the attacker controls another multisignature wallet belonging to the affected investor. This wallet has a large leveraged position open on the DeFi platform Aave: $25 million in Ethereum has been posted as collateral, against which $12.3 million in DAI stablecoins has been borrowed. This creates additional risk for the investor’s financial stability and could lead to unexpected liquidations if market conditions change.

The case highlights the need not only for multi-layer protection of private keys, but also for regular auditing and monitoring of multisignature wallets, especially when managing large amounts of cryptocurrency and participating in high-risk DeFi protocols. Analysts warn that such attacks will continue to occur, as attackers look for vulnerabilities even in the most secure digital asset storage systems.

The financial community and crypto investors are now closely watching the response of the platforms involved in this incident and expect stronger security measures to prevent similar large-scale thefts in the future.

Here, by the way, you can buy legendary hardware wallets for beginners with all the basic functions!

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.